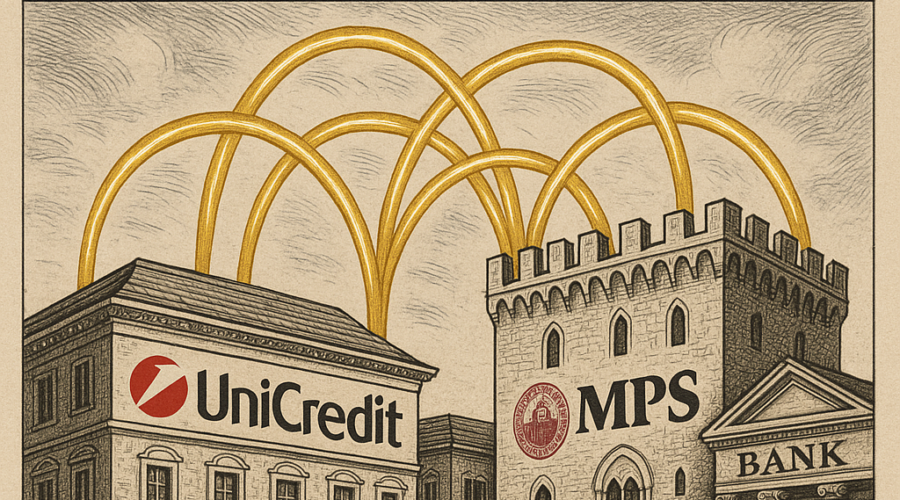

UniCredit SpA dismissed speculation about pursuing a stake in Monte dei Paschi di Siena SpA, stating it evaluates all mergers and acquisitions opportunities without committing to specific targets. The comments from Chief Executive Officer Andrea Orcel, made during a January 2026 investor call, underscore caution in Italy’s banking sector as cross-border M&A trends in European finance intensify.

Set and exceed synergy goals with benchmarks and actionable operational initiative level data from similar deals from your sector:

💼 Actionable Synergies Data from 1,000+ Deals!

Context of the Rumors

Reports in late 2025 fueled talk of UniCredit revisiting a potential investment in MPS, Italy’s third-largest lender by assets, following a failed 2021 approach. UniCredit had then offered to buy a 9% stake but withdrew amid regulatory pushback from the European Central Bank and Italian authorities. MPS, rescued by the state in 2017 with €8.1 billion in aid, has since stabilized under CEO Luigi Lovaglio, posting a €1.2 billion net profit in 2025 on cost cuts and loan growth.

Orcel’s statement aligns with UniCredit’s strategy to prioritize organic growth and bolt-on deals. “We study all options, but no decisions are made on rumors,” he said, per a transcript reviewed by The Wall Street Journal. Shares in UniCredit fell 1.2% in Milan trading, while MPS gained 0.8%.

Financial Snapshot: UniCredit vs. MPS

| Metric (2025) | UniCredit | MPS |

|---|---|---|

| Market Cap (€B) | €65.3 | €8.7 |

| CET1 Ratio (%) | 15.2 | 13.8 |

| Net Profit (€B) | €8.4 | €1.2 |

Strategic Rationale and Synergies

A UniCredit-MPS tie-up could yield €1.5 billion in annual cost synergies, per Goldman Sachs estimates from 2025, through branch overlaps in central Italy and shared back-office functions. UniCredit’s pan-European footprint—spanning Germany via HypoVereinsbank and CEE markets—would complement MPS’s domestic retail strength. However, integration risks include €2-3 billion in restructuring costs and potential layoffs affecting 5,000-7,000 staff, based on McKinsey analysis of prior Italian bank mergers like Intesa Sanpaolo-UCG in 2007.

Bain & Company notes in its 2026 European Banking M&A Outlook that Italian deals face heightened scrutiny under EU Capital Markets Union rules, with state ownership in MPS (28% stake) complicating privatization. “Cross-border M&A in banking requires 20-30% CET1 buffers for regulators,” a Bain report states.

Broader European Banking M&A Trends

UniCredit’s stance reflects a pickup in sector activity. Deal volume rose 25% year-over-year in 2025, per Dealogic, driven by low valuations (European banks trade at 0.7x book value) and rate normalization. Notable precedents:

- BBVA’s €12 billion hostile bid for Sabadell (2024, ongoing).

- Unicaja-Bankinter merger talks (2025, valued at €15 billion).

- France’s Société Générale eyeing Commerzbank (rumored 2026).

Private equity interest grows, with KKR and Apollo scouting non-core assets. Kirkland & Ellis partners highlight antitrust risks under the EU’s Digital Markets Act for deals exceeding €5 billion. UniCredit’s €10 billion excess capital provides firepower for M&A, but Orcel prioritizes dividends (payout ratio 50%) and buybacks.

Implications for Investors

For C-level executives and deal advisors tracking European bank consolidation strategies, UniCredit’s flexibility signals opportunistic moves amid 2026’s projected 15% rise in M&A, per BCG. Regulatory green lights could unlock value, but political hurdles in Italy persist. Watch UniCredit’s Q4 earnings on February 5 for further clues on Italian banking M&A opportunities.

Sources