A prominent hedge fund has leveled serious conflict-of-interest allegations against **Kirkland & Ellis**, the go-to law firm for private equity giants, in a lawsuit centered on a contentious **continuation vehicle** transaction. The case underscores rising tensions in **private equity exit strategies** amid thawing credit markets and renewed deal activity as of early 2026.[1][3]

Set and exceed synergy goals with benchmarks and actionable operational initiative level data from similar deals from your sector:

💼 Actionable Synergies Data from 1,000+ Deals!

The Core Allegations: Conflicts in Continuation Vehicle Deal

The dispute erupted from a **continuation vehicle**—a mechanism private equity firms use to extend holdings in high-performing assets by transferring them from a maturing fund to a new one, often with limited partner consent. A hedge fund accuses **Kirkland & Ellis** of breaching loyalty by representing conflicting parties in the deal, potentially favoring the general partner over dissenting investors. This mirrors broader scrutiny on legal advisors in **private equity restructurings**, where firms like Kirkland handle billions in GP-led secondaries.[3]

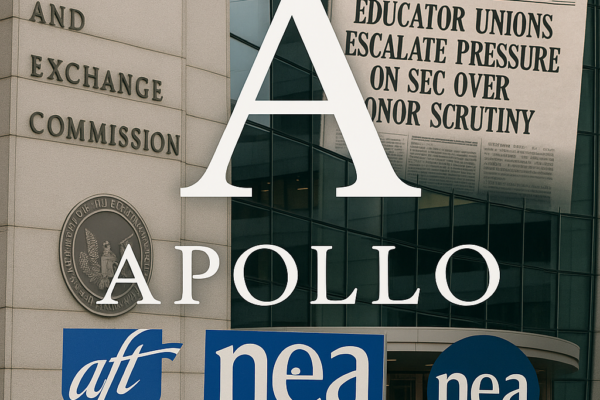

Details remain sparse, but the suit highlights how **Kirkland & Ellis**, known for advising KKR, Blackstone, and Apollo on mega-deals, navigates overlapping representations. Industry observers note that such conflicts are increasingly litigated as LPs push back against perceived value extraction in illiquid markets.[1][3]

Broader Context: Deal Season Revival Amplifies Risks

The timing aligns with a **private equity M&A rebound**, fueled by accessible financing after two years of frozen credit. Investment banks project $38 billion in 2025 fees, a 50% surge from 2023 lows, driven by AI infrastructure buildouts, IPOs, and equity/debt raises for data centers and chips.[1]

In this environment, **continuation vehicles** have surged as **private equity exit strategies in uncertain markets**, with GP-led transactions hitting record volumes. However, they invite disputes over valuation, fees, and fairness—echoing Delaware Chancery Court cases like the $4.85 million settlement in Sterling Partners’ Keypath Education take-private.[2]

| Case | Value/Stake | Key Issue | Outcome (as of Jan 2026) |

|---|---|---|---|

| Sterling Partners v. Keypath (Ed-Tech Take-Private) | $4.85M settlement | Fiduciary duty claims | Court-approved[2] |

| Eventbrite $500M Take-Private | $500M | Voting agreement & proxy misleading | Pending challenge[2] |

| Ready Capital/Broadmark REIT Merger | $787M | Proxy disclosure | Motion to dismiss filed[2] |

Implications for Private Equity Leaders and Advisors

- Regulatory and Litigation Risk Surge: With **cross-border M&A trends 2025** carrying into 2026, funds must scrutinize counsel waivers. Kirkland’s dominance—advising on 30%+ of large-cap buyouts—amplifies fallout potential.[1]

- LP Pushback on GP Interests: Continuation vehicles face heightened Delaware scrutiny, as seen in noncompete enforcements favoring PE buyers (e.g., Derge v. D&H).[2]

- Market Tailwinds vs. Headwinds: While AI-driven deals boost activity, conflicts erode trust. PE firms like those backed by McKinsey-noted strategies should prioritize independent valuations in **GP-led secondaries**.[1][3]

For C-suite executives and deal advisors, this spat signals a need for robust conflict checks in **private equity portfolio company transactions**. As markets thaw, transparency will define winners in the next deal cycle.

Sources

https://www.shortsqueez.co/p/deal-season-is-back, https://www.law360.com/mergersacquisitions, https://www.opalesque.com