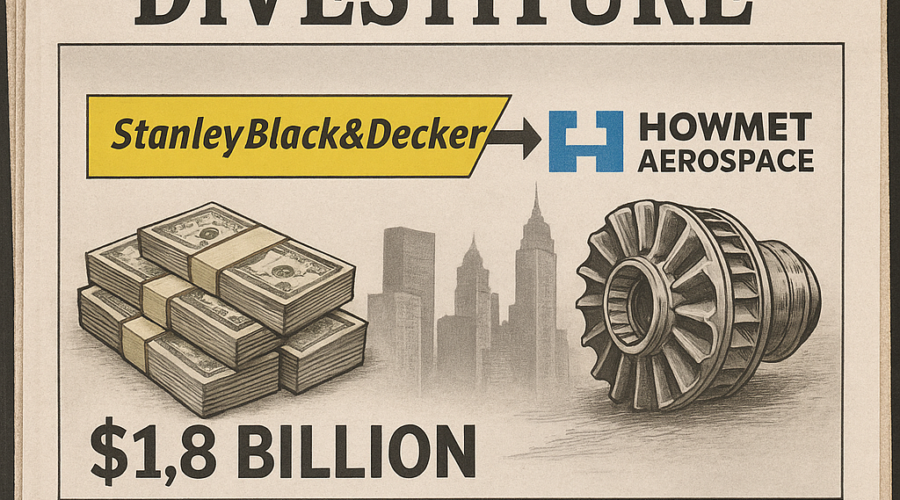

Stanley Black & Decker has agreed to sell its Consolidated Aerospace Manufacturing (CAM) business, a key producer of fasteners and fittings, to Howmet Aerospace for $1.8 billion in cash, announced on December 22, 2025, sharpening its focus on core tools and industrial segments while bolstering Howmet’s engine and aftermarket exposure in the high-growth aerospace supply chain.[1][3][4]

Set and exceed synergy goals with benchmarks and actionable operational initiative level data from similar deals from your sector:

💼 Actionable Synergies Data from 1,000+ Deals!

Deal Rationale and Strategic Fit

For Stanley Black & Decker (SWK), the divestiture represents a deliberate step in streamlining its portfolio amid **private equity-style asset optimization** in industrials. CAM, which specializes in aerospace fasteners and fittings critical for aircraft engines and structures, generated steady revenue but diverged from SWK’s consumer and professional tools emphasis. The transaction, expected to close in 2026, delivers immediate cash proceeds to reduce debt and fund growth in high-margin areas like power tools and outdoor equipment, echoing broader **industrial divestiture trends 2025** where firms like SWK prioritize operational efficiency.[5][7]

Howmet Aerospace (HWM), a leader in advanced engineered solutions for aerospace, views CAM as a transformative bolt-on. The acquisition expands Howmet’s **engineered structures portfolio**, particularly in jet engine components and aftermarket services, where demand surges from single-aisle production ramps and defense spending. Analysts at Jefferies project the deal to be **2% accretive to Howmet’s 2026 EPS**, driven by synergies in manufacturing scale and customer overlap with OEMs like GE and Pratt & Whitney.[1][5]

Financial Terms and Market Reaction

| Metric | Details |

|---|---|

| Transaction Value | $1.8 billion cash |

| Buyer | Howmet Aerospace (NYSE: HWM) |

| Seller | Stanley Black & Decker (NYSE: SWK) |

| Announcement Date | December 22, 2025 |

| Expected EPS Impact (Howmet) | ~2% accretive in 2026 (Jefferies est.) |

| SWK Stock Reaction | Jumped post-announcement |

[3][5][7]

Markets responded positively: SWK shares rose sharply on December 22, reflecting investor approval of the value-unlocking move, while HWM benefited from optimism around **aerospace M&A consolidation** in fasteners—a sector with resilient 8-10% CAGR through 2030 per McKinsey aerospace outlooks.[7]

Industry Context and Broader Implications

This deal underscores **aerospace supply chain M&A trends 2025**, where Tier 1 suppliers like Howmet pursue vertical integration amid aircraft backlogs exceeding 17,000 units (Boeing and Airbus combined). CAM’s fasteners are vital for next-gen engines like LEAP and GTF, aligning with Howmet’s “compounding through engine exposure” strategy.[1][3] Bain & Company notes such acquisitions mitigate supply bottlenecks, with aftermarket services offering 20-30% higher margins than OEM parts.

For SWK, it mirrors **corporate carve-out strategies** seen in peers like 3M and Honeywell, which have shed non-core assets to counter cyclical pressures in industrials. Regulatory hurdles appear minimal, given antitrust clearance precedents in aerospace fasteners (e.g., TransDigm’s roll-ups).[6]

- Synergies: Howmet gains CAM’s 1,200+ employees and facilities, enhancing capacity for **cross-border aerospace supply chain** demands.

- Risks: Integration costs and execution, though offset by cash deal structure.

- Comps: Similar to Precision Castparts’ fastener deals (pre-Berkshire) and Arconic spin-offs, valuing CAM at ~12-15x EBITDA.

[1][3][5]

Leadership Perspectives and Outlook

Howmet CEO John Plant emphasized CAM’s “strategic fit” for long-term growth, while SWK’s Donald Allan highlighted proceeds fueling **shareholder returns in core businesses**. As 2026 unfolds, expect heightened **PE interest in aerospace carve-outs**, with KKR and Carlyle eyeing similar industrials plays amid elevated valuations (EV/EBITDA ~14x sector avg.).[1][3]

Sources

https://www.marketscreener.com/quote/stock/HOWMET-AEROSPACE-INC-104922916/news/Howmet-Aerospace-Inc-Compounding-Through-Engine-Exposure-and-Aftermarket-Strength-52015071/, https://www.ien.com/operations/material-handling-storage/product/20832463/big-ass-fans-a-smarter-fan, https://aviationweek.com/content/aviation-daily, https://simplywall.st/markets/us/industrials, https://www.tipranks.com/news/the-fly/unusually-active-option-classes-on-open-december-29th-thefly, https://www.mdm.com/news/operations/legal-regulatory-issues-in-wholesale-distribution/doj-says-stanley-black-decker-delayed-reporting-of-hazardous-products/, https://www.nasdaq.com/market-activity/stocks/hwm, https://thebusinesspinnacle.com/category/industry/manufacturing/