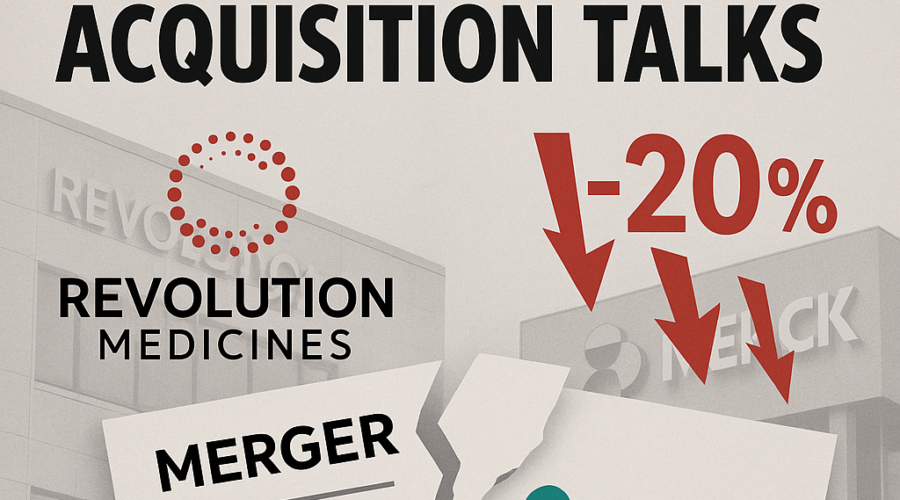

Merck & Co. has terminated acquisition discussions with Revolution Medicines after failing to agree on price for a potential $28-32 billion deal, triggering a 20% drop in Revolution’s shares and exposing tensions in **biotech M&A valuation** amid high-stakes oncology innovation.[1][3]

Set and exceed synergy goals with benchmarks and actionable operational initiative level data from similar deals from your sector:

💼 Actionable Synergies Data from 1,000+ Deals!

The breakdown underscores **Big Pharma acquisition strategies** clashing with biotech sellers’ premium expectations, as Revolution Medicines—developer of pan-RAS inhibitors for hard-to-treat cancers—sought a valuation exceeding its $23 billion market cap.[1][3] Earlier reports indicated interest from multiple suitors, including AbbVie, which denied advanced talks.[3][10]

Deal Dynamics: Valuation Gap Halts Biotech Consolidation Play

Merck’s walkaway reflects broader **pharma M&A trends 2026**, where buyers prioritize risk-adjusted returns amid patent cliffs and regulatory pressures, while sellers leverage trial momentum for outsized premiums.[1] Revolution’s insistence on a higher price highlights investor optimism around its RAS platform, targeting mutations driving 30% of cancers including pancreatic, lung, and colorectal.[1][3]

| Aspect | Merck Perspective | Revolution Medicines Perspective |

|---|---|---|

| Proposed Valuation | $28-32 billion | >$23 billion market cap |

| Key Asset | RAS inhibitors as pipeline filler | Pan-RAS breakthrough for $100B oncology market |

| Risk Focus | Trial outcomes, competition | Phase III catalysts |

Industry observers note this impasse mirrors recent **biotech takeover failures**, where Phase III readouts dictate premiums. McKinsey’s 2025 M&A report flagged oncology as a consolidation hotspot, with Big Pharma deploying $150 billion in dry powder for bolt-on assets to offset Keytruda-like blockbusters nearing expiration.[1]

Revolution’s RAS Pipeline: High-Risk, High-Reward Bet

Central to the deal was **daraxonrasib**, Revolution’s lead pan-RAS inhibitor showing 35-47% response rates in early trials for pancreatic and non-small cell lung cancer.[1] The ongoing Phase III RASolute 302 trial, with data expected in 2026, represents a pivotal catalyst that could validate a $100 billion addressable market or spark further sell-offs.[1]

- Pipeline Strengths: Multi-selective RAS targeting, once deemed “undruggable,” positions Revolution ahead of rivals in a sector ripe for **oncology M&A deals 2026**.[1]

- Risks: Binary trial outcomes; limited standalone path without blockbuster approval or buyer.[1]

- Post-Deal Signals: Slowed insider selling suggests management confidence.[1]

Current $23 billion market cap trades below pre-rumor highs, prompting some to view it as a **biotech buying opportunity post failed acquisition** if RASolute data succeeds.[1] Goldman Sachs analysts recently raised RVMD price targets to $92.82, citing pipeline durability.[2]

Implications for Biotech M&A and Investor Strategy

The failed talks signal caution in **cross-border biotech M&A trends 2025-2026**, with valuation disputes accelerating amid elevated interest rates and FDA scrutiny. Bain & Company’s outlook predicts 15-20% fewer mega-deals in 2026, favoring phased investments over outright buys.[1][3] For Revolution, sustained interest from peers like Pfizer or Roche remains likely, given RAS’s strategic fit.

Private equity and crossover funds may eye opportunistic stakes, echoing KKR’s playbook in undervalued biotech platforms. Merck, meanwhile, refocuses on internal R&D, including Keytruda extensions, as institutional holders like BCS Wealth Management bolster positions.[4][5]

For C-level executives and deal advisors, this episode reinforces diligence on **private equity exit strategies in biotech**—prioritize trial milestones over rumor-driven spikes.

Sources

https://www.ainvest.com/news/collapse-merck-takeover-talks-revolution-medicines-implications-biotech-valuation-momentum-2026-2601/, https://www.nasdaq.com/market-activity/stocks/rvmd/news-headlines, https://www.statnews.com/pharmalot/2026/01/26/pharma-lobbying-novo-genes-fda-patents/, https://www.gurufocus.com/news/8550978/bcs-wealth-management-buys-16212-shares-of-merck-co-inc-mrk, https://www.gurufocus.com/news/8550866/prairiewood-capital-llc-buys-2000-shares-of-merck-co-inc-mrk, https://medwatch.com/News/Pharma___Biotech/article18956256.ece, https://www.nasdaq.com/market-activity/stocks/chscm, https://www.marketscreener.com/news/planting-hedges-early-ce7e5bdbdd8cf227, https://www.marketbeat.com/stocks/NYSE/MRK/news/, https://www.tipranks.com/news/topic/abbv