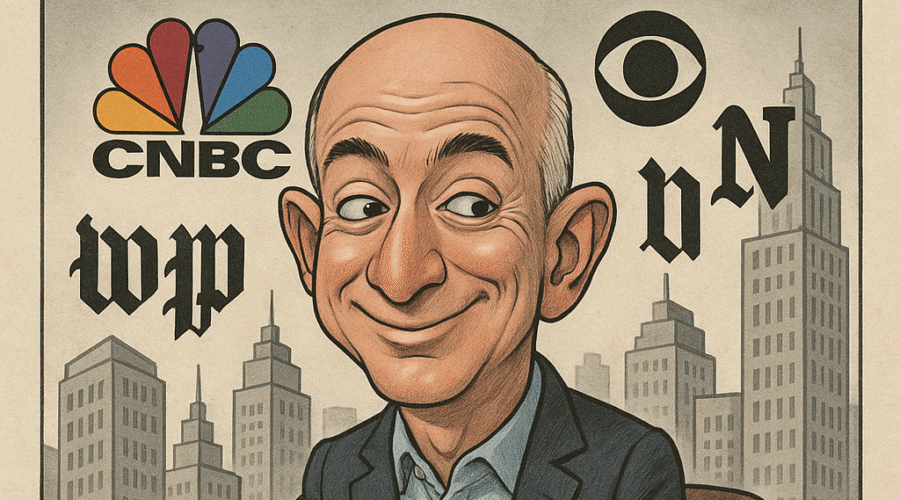

Jeff Bezos has categorically denied reports of considering a bid for CNBC, as the business network prepares for a spinoff from Comcast into a new entity called Versant. Sources close to the Amazon founder rejected claims from the New York Post that he sought to expand his media holdings beyond The Washington Post, which has faced recent editorial and financial challenges. The denial comes as Comcast finalizes its restructuring, with Versant poised to become a publicly traded company by year-end.

💼 M&A / PE diligence in 24 hours? Yes, thanks to AI!

Bezos’ Denial and Strategic Context

Multiple sources confirmed Bezos has not approached Comcast about acquiring CNBC, despite initial speculation. A person familiar with Bezos’ thinking told The Daily Beast there was “not a shred of truth” to the rumors, emphasizing that CNBC would not align with his current priorities[1][5]. The rebuttal followed reports suggesting Bezos viewed the network as a “neutral voice” to balance his media portfolio, which includes The Washington Post[2][6].

Comcast’s Versant Spinoff and CNBC’s Future

Comcast plans to separate its cable assets—including CNBC, MSNBC, USA Network, and E!—into Versant Media Group, a move expected to complete by December 2025. The spinoff aims to streamline operations and focus on high-growth areas like streaming (Peacock) and theme parks[1][6]. CNBC, which generated $7 billion in revenue last year, will remain under Versant’s leadership, with CEO Mark Lazarus overseeing the new entity[6][8].

Crucially, Versant faces a two-year restriction on selling major assets like CNBC without triggering significant tax liabilities. This regulatory hurdle complicates any near-term acquisition, as Comcast has signaled no interest in divesting CNBC immediately[6][8].

Bezos’ Media Strategy and The Washington Post’s Challenges

Bezos’ denial contrasts with his active media investments, most notably The Washington Post, acquired for $250 million in 2013. Under his ownership, the Post has pursued digital transformation but faced backlash for editorial shifts toward centrist, pro-capitalist positions. These changes led to staff protests, layoffs, and a reported 300,000 subscription cancellations after the paper declined to endorse Kamala Harris in 2024[2][6][10].

Potential Motivations for CNBC Interest

Analysts speculated that CNBC could complement Bezos’ portfolio by providing a platform for business-focused content, leveraging Amazon’s data capabilities and Prime Video infrastructure. However, the Post’s recent turmoil—including editorial conflicts and financial losses—has raised questions about Bezos’ appetite for additional media ventures[6][11].

Implications for Media Consolidation and Regulatory Scrutiny

A potential Bezos-CNBC deal would have intensified scrutiny of Big Tech’s media influence, particularly given Amazon’s dominance in e-commerce and cloud computing. Regulators might view such a move as anticompetitive, especially if integrated with Amazon’s advertising or streaming platforms[12][13].

Comcast’s spinoff strategy reflects broader industry trends toward streamlining assets and focusing on core competencies. For Bezos, the denial underscores a cautious approach to media expansion amid ongoing challenges at the Post and shifting regulatory landscapes[6][8].

Conclusion: Strategic Prudence or Missed Opportunity?

Bezos’ denial highlights his prioritization of stability over speculative media ventures. While CNBC could have offered synergies with Amazon’s ecosystem, the risks—including regulatory hurdles, tax implications, and operational complexities—likely outweighed potential benefits. The decision aligns with Bezos’ historical preference for strategic, long-term investments over reactive acquisitions.

As Versant navigates its post-spinoff trajectory, Bezos’ media ambitions remain a subject of speculation. Whether he revisits CNBC or pursues other opportunities (e.g., Vogue or Condé Nast) will depend on his ability to balance financial discipline with his vision for shaping public discourse.

Sources

https://www.thedailybeast.com/jeff-bezos-denies-he-wants-to-add-tv-news-network-cnbc-to-his-media-empire/, https://popculture.com/celebrity/news/jeff-bezos-eyes-purchase-of-major-cable-channel-report-claims/, https://cordcuttersnews.com/amazons-jeff-bezos-eyes-buying-cnbc/, https://www.youtube.com/watch?v=-lYAY__07Wg, https://www.threads.com/@thedailybeast/post/DMeWu0zIOFm/jeff-bezos-is-not-considering-a-bid-to-buy-cnbc-a-source-close-to-bezos-has-told, https://www.idnfinancials.com/news/56119/jeff-bezos-eyeing-acquisition-of-cnbc-business-tv-whats-his-motive, https://www.amworldgroup.com/blog/jeff-bezos-amazon-founder-business-empire-pr-strategy, https://www.hindustantimes.com/world-news/us-news/buying-cnbc-could-be-tricky-insider-on-jeff-bezoss-new-interest-in-cable-network-101753307101727.html, https://www.youtube.com/watch?v=EXJQoxqAWUM, https://www.bu.edu/articles/2024/lack-of-endorsement-shows-bezos-willing-to-bow-to-trump/, https://news.sky.com/story/bezoss-washington-post-bends-the-knee-again-amid-trumps-war-on-mainstream-media-13318715, https://www.stopthepresses.news/p/the-ap-ban-the-press-pool-takeover, https://www.webpronews.com/jeff-bezos-eyes-cnbc-acquisition-to-grow-media-empire/, https://talkingbiznews.com/media-news/ny-post-bezos-eyes-buying-cnbc/, https://www.bloomberg.com/news/articles/2025-07-24/comcast-spinoff-s-board-nominees-have-deals-ai-experience