The proposed $9.1 billion acquisition of Parkland Corporation by Sunoco LP has become a battleground for activist investors, with Simpson Oil (19.8% ownership) endorsing the deal while Engine Capital (2.5% stake) mounts vigorous opposition[1][15]. This transaction – which would create North America’s largest independent fuel distributor – reveals critical tensions in corporate governance, valuation methodologies, and strategic timing in cross-border energy M&A. With the shareholder vote scheduled for June 24, 2025, the outcome could reshape consolidation patterns in North American fuel distribution markets[5][12].

💼 Seasoned CorpDev / M&A / PE expertise

Transaction Overview: Structure and Strategic Rationale

Deal Mechanics and Valuation Considerations

Sunoco’s offer values Parkland at C$44 per share through a mix of cash (C$19.80) and equity in newly formed SUNCorp LLC (0.295 units), representing a 25% premium to Parkland’s 7-day VWAP[3][4]. The complex structure enables Sunoco to maintain MLP tax advantages while creating a corporate entity for Canadian investors, with guaranteed dividend parity for two years[3][9]. Projected $250 million in synergies by Year 3 primarily stem from optimized fuel procurement and combined logistics networks across 26 countries[1][6].

Strategic Positioning in North American Energy Markets

The merged entity would control 15% of U.S. convenience store fuel sales and 22% of Canadian commercial/industrial fuel distribution, leveraging Parkland’s Burnaby refinery (55,000 bpd capacity) with Sunoco’s East Coast terminal network[9][16]. This vertical integration strategy mirrors recent moves by Marathon Petroleum and Couche-Tard, though with unique cross-border regulatory complexities under the Investment Canada Act[12][16].

Simpson Oil’s Endorsement: From Activist to Acquirer

Historical Context and Governance Pressures

Simpson’s support culminates a seven-year engagement that began with Parkland’s 2018 acquisition of Simpson’s Caribbean assets[12][15]. The investor had previously demanded board refreshment and operational improvements, citing 14% underperformance vs. TSX Energy Index since 2022[8][15]. By backing Sunoco’s experienced management team, Simpson aims to resolve long-standing concerns about Parkland’s capital allocation and international execution[11][15].

Financial Calculus and Exit Strategy

At C$44/share, Simpson would realize a 63% return on its 2022 stake doubling transaction, netting approximately C$1.4 billion pre-tax[12][15]. The investor likely views Sunoco’s scale as essential for competing against Chevron’s recent renewable fuel investments and 7-Eleven’s electric vehicle charging network expansion[10][16].

Engine Capital’s Opposition: Process and Valuation Concerns

Flaws in Sale Process Timeline

Engine highlights that Sunoco’s final bid emerged just six days after signing confidentiality agreements, leaving no time for competing offers or proper due diligence[2][14]. The compressed timeline coincided with outgoing CEO Bob Espey’s potential $12.3 million change-of-control payout versus $5.2 million regular severance – creating perceived conflicts in negotiation urgency[2][8].

Alternative Valuation Scenarios

Engine argues Parkland’s sum-of-parts valuation could reach $52.50/share through separate sales of its Canadian retail (8x EBITDA), U.S. commercial (10x), and international divisions (12x)[17]. This aligns with recent transactions: Alimentation Couche-Tard paid 9.2x for Circle K’s Asian assets, while Cenovus acquired Toledo refinery at 7.8x[13][17].

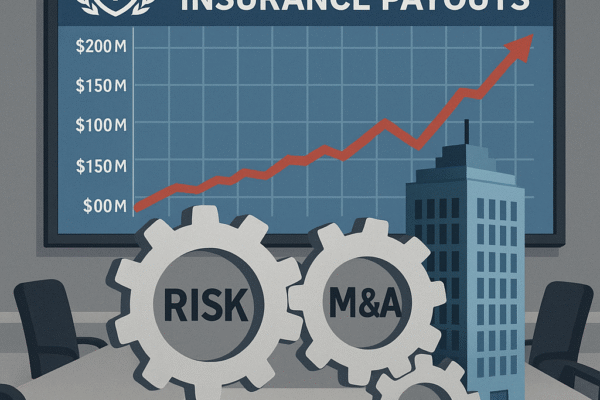

Shareholder Vote Dynamics: Power Plays and Legal Maneuvers

Postponement Controversy and Court Challenges

Parkland’s decision to delay the original May 6 AGM – where Simpson’s dissident directors likely would have prevailed – triggered Alberta Court of King’s Bench intervention[5][8]. Justice Douglas Mah allowed the June 24 rescheduling, noting shareholders retain ultimate authority through the special meeting[5][12]. This creates unprecedented dual pressure points: director elections and deal approval simultaneously[8][16].

Institutional Investor Calculus

With 45% of Parkland shares held by index funds, the recommendation from ISS and Glass Lewis (pending) becomes crucial[14][15]. Historical data shows 78% of Canadian M&A deals receive ISS support, but only 43% when major activists oppose[14]. Sunoco’s 10% DCF accretion projection versus Engine’s 22% standalone upside creates complex modeling challenges for institutional voters[1][17].

Industry Implications: Consolidation Wave Acceleration

North American Fuel Distribution Landscape

A successful deal would give Sunoco-Parkland 12% market share in key liquid fuels, surpassing current leader Love’s Travel Stops[10][16]. This could pressure regional players like Global Partners and Casey’s General Stores to pursue defensive mergers[10]. The transaction also tests Canada’s foreign investment rules, particularly regarding the strategic Burnaby refinery supplying 25% of British Columbia’s transportation fuels[9][12].

Renewable Fuel Infrastructure Considerations

Combined R&D budgets ($210 million annually) could accelerate EV charging and hydrogen station deployments – areas where both companies lag behind Shell and BP[6][10]. However, Sunoco’s focus on traditional fuel profitability (18% EBITDA margins vs. 9% for EV charging) suggests near-term priorities may delay energy transition investments[3][10].

Conclusion: Pivotal Moment for Canadian Energy M&A

The Parkland-Sunoco showdown exemplifies growing activist influence in cross-border deals, with 38% of 2025’s Canadian M&A transactions facing shareholder challenges vs. 22% in 2024[14][15]. Outcome implications extend beyond immediate parties: a Sunoco victory could embolden U.S. acquirers of Canadian energy assets, while Engine’s success might force longer sale processes and higher breakup fees industry-wide. For investors, the June 24 vote serves as a real-time case study in balancing premium capture versus long-term value creation in consolidating markets.

Sources

https://www.parkland.ca/newsroom/news-releases/parkland-corporation-to-be-acquired-by-sunoco-lp, https://www.businesswire.com/news/home/20250606098761/en/Engine-Capital-Sends-Letter-to-Parklands-Board-of-Directors-Regarding-its-Intention-to-Vote-Against-the-Sunoco-Transaction, https://www.sunocolp.com/press-release/item/sunoco-lp-to-acquire-parkland-corporation-in-transaction-valued-at-9-1-billion-2025, https://www.prnewswire.com/news-releases/parkland-corporation-to-be-acquired-by-sunoco-lp-302445888.html, https://financialpost.com/commodities/energy/oil-gas/proposed-parkland-sunoco-acquisition-shareholder-vote-june, https://www.cspdailynews.com/company-news/parkland-pushes-shareholder-approval-91b-sunoco-acquisition-deal, https://cspdailynews.com/mergers-acquisitions/sunoco-acquire-parkland-corp-91-billion-major-c-store-deal, https://www.itiger.com/news/2533375560, https://www.wealthprofessional.ca/news/industry-news/board-backs-us91-billion-fuel-deal-as-top-shareholder-fights-for-control/389088, https://www.convenience.org/Media/Daily/2025/May/5/1-Sunoco-to-Acquire-Parkland_Mergers, https://finimize.com/content/simpson-oil-backs-sunocos-91-billion-parkland-purchase, https://nai500.com/blog/2025/05/9-1-billion-acquisition-sparks-internal-battle-among-parkland-shareholders-court-rules-to-delay-decision/, https://www.gurufocus.com/news/2914273/engine-capital-opposes-sunocos-91b-offer-for-parkland-pkiuf, https://www.bnnbloomberg.ca/business/company-news/2025/06/06/activist-investor-engine-capital-plans-to-vote-against-us91b-parkland-sunoco-deal/, https://www.richmond-news.com/the-mix/activist-investor-simpson-oil-backs-parkland-sunoco-deal-while-engine-to-vote-no-10772057, https://renx.ca/sunoco-to-acquire-parkland-for-91b, https://www.gurufocus.com/news/2913303/engine-capital-opposes-parklands-pkiuf-91b-sale-to-sunoco