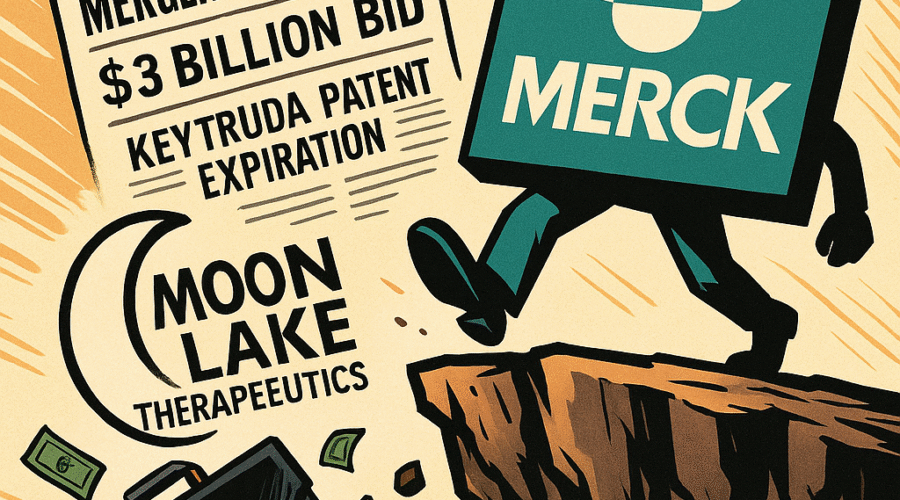

As Merck & Co. confronts the impending 2028 patent expiration of its $29.5 billion oncology blockbuster Keytruda, the pharmaceutical giant’s reported $3 billion pursuit of MoonLake Immunotherapeutics reveals a calculated strategy to dominate emerging immunology markets. This potential acquisition of MoonLake’s IL-17A/F inhibitor sonelokimab could provide Merck with a first-mover advantage in treating hidradenitis suppurativa (HS) – a chronic inflammatory condition affecting 2% of global adults – while establishing beachheads in psoriatic arthritis and axial spondyloarthritis. With Phase 3 data expected September 2025 showing 75% clinical response rates, this deal exemplifies Big Pharma’s race to offset $15 billion annual revenue cliffs through precision biologics acquisitions[1][4][16].

💼 Seasoned CorpDev / M&A / PE expertise

The Keytruda Countdown: Merck’s $15 Billion Annual Revenue at Risk

Keytruda’s dominance as the world’s top-selling drug masks a critical vulnerability – 46% of Merck’s 2024 $64.2 billion revenue depends on a therapy facing 2028 patent expiration[8]. While Merck has filed 129 patents to extend protection through 2036 via formulation and indication claims, analysts project biosimilar competition could erase $15 billion annually by 2030[4][5]. This urgency explains Merck’s aggressive M&A strategy, having spent $11 billion on Acceleron (2021) and $10.8 billion on Prometheus Biosciences (2023) to diversify beyond oncology[17].

Sonelokimab’s Dual Mechanism: IL-17A/F Inhibition Breakthrough

MoonLake’s nanobody technology targets IL-17 dimers more effectively than existing IL-17A inhibitors like Novartis’ Cosentyx. Phase 2 HS trials demonstrated 75% HiSCR75 response versus 30% for TNF inhibitors, with 120mg doses achieving complete draining tunnel resolution in 58% of patients[12][13]. The drug’s 40kDa size enables deep tissue penetration critical for HS lesions – a key differentiator in the projected $15 billion HS market[3][16].

Deal Dynamics: Why MoonLake Rejected Merck’s Initial Offer

Merck’s $3 billion non-binding bid valued MoonLake at 1.15x its $2.6 billion pre-news market cap, but analysts suggest the biotech’s $500 million Hercules Capital financing and upcoming Phase 3 data create leverage for higher valuation[13][14]. With eight active Phase 2/3 trials across inflammatory indications and $948 million total liquidity, MoonLake could command $4.5-$5 billion if September data confirms HiSCR75 superiority[13][16].

| Therapy | Mechanism | HiSCR75 Rate | Market Potential |

|---|---|---|---|

| Sonelokimab | IL-17A/F Nanobody | 75% | $15B by 2035 |

| Adalimumab | TNF inhibitor | 28% | $4B (peak) |

Strategic Implications for Immunology Pipeline Development

Merck’s pursuit aligns with CEO Rob Davis’ strategy to build “a broad-based immunology company” through $1-$15 billion acquisitions[14][17]. Success would give Merck:

- First FDA-approved HS biologic with HiSCR75 endpoint

- Platform for 6+ inflammatory disease indications

- $1.2 billion in projected 2030 sales for psoriatic arthritis

Risks: Clinical, Competitive, and Integration Challenges

While sonelokimab’s Phase 2 data appears robust, the 800-patient VELA trial must confirm safety in long-term use – particularly for a drug targeting chronic conditions requiring multi-year treatment[12]. Competitors like Eli Lilly’s bimekizumab (IL-17A/F inhibitor) could challenge first-mover advantage, while Merck’s limited immunology commercial infrastructure may slow launch momentum compared to AbbVie or Janssen[16].

“Merck needs MoonLake’s clinical assets yesterday – this isn’t just pipeline diversification, it’s existential crisis management,” noted Leerink Partners analyst David Risinger[16].

Broader Biotech M&A Trends: 2025’s $28 Billion Surge

Merck’s move reflects sector-wide urgency, with April 2025 seeing $8.2 billion in deals including Novartis’ $1.7 billion Regulus acquisition[6]. Therapeutic area focus has shifted:

- 43% of Q1 2025 deals targeted immunology/inflammation

- 27% oncology (down from 38% in 2024)

- 19% rare diseases

Conclusion: A Pivotal Moment for Merck’s Post-Keytruda Future

As September’s Phase 3 data approaches, Merck faces pressure to secure MoonLake before rival bids emerge from Roche or Pfizer. With sonelokimab’s potential to generate $4 billion annual sales across indications by 2030, this $3 billion gambit could prove a masterstroke in immunology portfolio construction – provided integration challenges don’t dilute the science that makes MoonLake valuable[14][16].

Sources

https://www.ainvest.com/news/moonlake-merck-3-billion-opportunity-beat-patent-clock-2506/, https://www.ainvest.com/news/merck-30b-moonlake-acquisition-bid-rejected-2506/, https://moonlaketx.com/about-us/, https://www.biospace.com/business/just-how-steep-is-the-drug-patent-cliff-ask-these-pharmas, https://www.i-mak.org/wp-content/uploads/2021/05/i-mak.keytruda.report-2021-05-06F.pdf, https://www.labiotech.eu/trends-news/top-biotech-deals-april-2025/, https://www.merck.com/news/merck-to-acquire-harpoon-therapeutics-further-diversifying-oncology-pipeline/, https://www.echemi.com/cms/2235712.html, https://www.globalbankingandfinance.com/US-MOONLAKE-M-A-MERCK-CO-c9e9fe6a-27e7-4431-9c0e-3ede05b08324, https://www.tradingview.com/news/reuters.com,2025:newsml_L3N3S51AX:0-merck-held-talks-to-buy-biotech-moonlake-for-over-3-billion-ft-reports/, https://www.tradingview.com/news/reuters.com,2025:newsml_FWN3S50SW:0-merck-held-talks-to-buy-swiss-biotech-moonlake-for-more-than-3-bln-ft/, https://www.dermatologytimes.com/view/moonlake-s-sonelokimab-trial-for-hs-advances-to-phase-3, https://www.stocktitan.net/news/MLTX/moon-lake-secures-up-to-500-million-in-non-dilutive-financing-from-qn1xh64y3h71.html, https://www.fiercebiotech.com/biotech/merck-made-3b-plus-offer-moonlake-and-could-revive-interest-late-phase-biotech-ft, https://www.pharmaceutical-technology.com/news/merck-kgaa-strikes-3-9bn-deal-for-springworks/, https://www.ainvest.com/news/merck-moonlake-gambit-lifeline-keytruda-patent-cliff-2506/, https://www.biopharmadive.com/news/merck-dealmaking-15-billion-keytruda-cliff-davis/706309/, https://www.pharmavoice.com/news/merck-pipeline-keytruda-patent-cliff/737188/