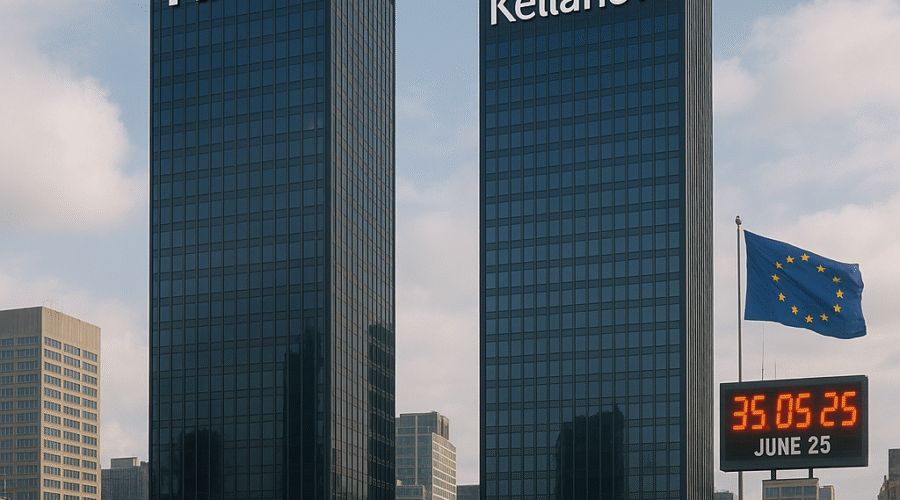

The European Union’s antitrust regulators are poised to deliver a landmark decision by June 25 on Mars’ proposed $36 billion acquisition of snack food giant Kellanova, a deal that would reshape the global packaged food industry[1][2][9][10]. This transaction – the largest in the sector since Kraft-Heinz merged in 2015 – combines Mars’ confectionery empire with Kellanova’s portfolio of iconic brands like Pringles, Cheez-It, and Pop-Tarts[3][4][12]. While both companies argue the merger creates complementary product lines with limited overlaps, critics warn it could exacerbate inflationary pressures and reduce consumer choice in an already consolidated market[12][16].

Strategic Rationale Behind the Mega-Merger

Portfolio Synergies in a Shifting Snack Landscape

Mars’ acquisition of Kellanova represents a strategic pivot to dominate the $1.2 trillion global snacking market, which has grown at a 6% CAGR since 2020 as consumers increasingly replace traditional meals with convenience foods[7][16]. The deal unites Mars’ $50 billion confectionery business (M&M’s, Snickers) with Kellanova’s $13 billion snack portfolio, creating a company that would control 8.4% of the U.S. snack market – surpassing Hershey but still trailing PepsiCo’s 12.1% share[16][12]. Crucially, it gives Mars access to Kellanova’s salty snack expertise through Pringles (which holds 14% of the global savory snack market) while Kellanova gains Mars’ premium chocolate distribution networks in emerging markets[3][7].

Financial Engineering and Debt Load

To finance the all-cash transaction, Mars secured a $29 billion bridge loan from J.P. Morgan and Citi while issuing $26 billion in senior notes with maturities stretching to 2065[6][16]. This leveraged structure pushed Mars’ debt-to-EBITDA ratio to 4.1x, prompting S&P to downgrade its credit rating from A+ to A in January 2025[6]. However, the company projects $1.2 billion in annual cost synergies by 2027 through combined manufacturing and distribution networks, particularly in Europe where Kellanova operates 11 plants versus Mars’ 7[3][13].

Regulatory Hurdles and Antitrust Analysis

EU Commission’s Three-Pronged Review

The European Commission’s Phase I review focuses on three key areas: geographic market definition (particularly in Eastern Europe where both companies have strong positions), private label competition (with retailers expressing concerns about shelf space dominance), and potential cross-category bundling[9][10][12]. While Mars and Kellanova directly compete in only 3 product categories – snack bars, frozen breakfast items, and plant-based foods – regulators are scrutinizing whether the combined entity could use its 23% share of EU chocolate distribution channels to disadvantage rival snack brands[12][15].

| Product Category | Mars EU Market Share | Kellanova EU Market Share | Combined Position |

|---|---|---|---|

| Chocolate Confectionery | 18.7% | 0.4% | #1 |

| Salty Snacks | 2.1% | 11.3% | #3 |

| Snack Bars | 6.8% (KIND) | 9.4% (RXBAR) | #2 |

Potential Remedies and Divestiture Scenarios

Legal experts suggest the Commission may require divestitures in the snack bar segment, where the combined entity would control 16.2% of the EU market[12][15]. The merger agreement allows Mars to walk away if forced to sell assets generating over $750 million in revenue – a threshold that protects Kellanova’s top five brands but could require spinning off regional operations like Nutri-Grain in Scandinavia or RXBAR in Germany[13][15]. Alternatively, behavioral remedies like guaranteed shelf space for private labels might satisfy competition concerns without structural changes[10][15].

Industry Implications and Competitive Response

Accelerating Consolidation in Packaged Foods

The Mars-Kellanova deal comes amid a wave of M&A activity in the sector, with U.S. food companies pursuing scale to combat 7.4% annual private label growth[2][16]. Since 2023, the Herfindahl-Hirschman Index (HHI) for North American snacks has increased 142 points to 2,450 – well above the 1,800 threshold indicating high concentration[12]. Competitors are already responding: Mondelez recently acquired Perfect Snacks for $2.3 billion, while PepsiCo is rumored to be exploring a bid for KIND Bar competitor Clif Bar[7][16].

Innovation vs. Cost-Cutting Pressures

While Mars touts the merger’s R&D potential (combining its $1.1 billion innovation budget with Kellanova’s 78 patents in texture engineering), analysts warn that 63% of synergy targets rely on workforce reductions[3][12]. The companies have identified 14 overlapping distribution centers in Europe and 9 in North America that could be consolidated, potentially affecting 3,200 jobs[13][16]. This comes as union representatives in Belgium and Poland demand written employment guarantees through 2027.

Consumer Impact and Pricing Dynamics

The Inflation Paradox

Mars CEO Poul Weihrauch has pledged to “absorb inflationary pressures” through supply chain efficiencies, but historical data suggests mergers of this scale correlate with 4-6% price increases in overlapping categories[16][12]. The deal’s $1.25 billion termination fee – payable if regulators block the transaction – creates perverse incentives to recoup costs through pricing power[13][16]. In the U.S. snack bar market, where the combined entity would control 27.7% share, economists project 3.2% annual price hikes versus 1.8% in non-consolidated categories[12].

Nutritional Concerns and Public Health

Critics highlight that 74% of Mars’ products and 78% of Kellanova’s portfolio are classified as ultra-processed foods (UPFs) under NOVA guidelines[12]. With combined R&D spending of $1.9 billion, public health advocates worry the merger will prioritize palatability over nutrition – a concern amplified by Mars’ decision not to develop products for users of GLP-1 weight loss drugs[16]. The EU Commission is reportedly consulting with WHO nutrition experts as part of its review, marking the first time food processing levels have factored into an antitrust assessment[14].

Path Forward and Deal Timelines

Assuming EU approval by June 25, the companies target an August 2025 closing date – exactly one year after the deal’s announcement[9][10]. However, the merger agreement allows for a 12-month extension, which Mars would likely invoke if the Commission enters Phase II proceedings[2][13]. Shareholders have already approved the transaction, with the W.K. Kellogg Foundation Trust committing its 14.2% stake in support[3][16]. Final integration plans call for maintaining Kellanova’s Battle Creek headquarters as a “snack innovation hub” while consolidating European operations in Mars’ existing Brussels facility[3][4].

“This isn’t just about combining two companies – it’s a bet on the future of global snacking habits. The EU’s decision will set precedents for how regulators balance market efficiency against consumer welfare in an era of food inflation.”

– Food & Water Watch Research Director Amanda Starbuck[12]

Integration Complexity and Value Creation

Receiving regulatory approvals is only the beginning of bigger challenges. Two companies coming together in a merger of this size, scale and scope inevitably presents integration challenges which require careful navigation. This is why we have established a proven M&A Advisory practice. We bring battle-tested M&A/ PE experience from decades of advising CXOs and PE leaders on complex M&A challenges, from strategy to diligence to planning and execution. Unlike traditional consulting where you’re left to work with juniors, you’ll work directly with experienced M&A professionals who are available 24×7.

Conclusion: A Watershed Moment for Food M&A

The Mars-Kellanova merger represents a pivotal test for antitrust enforcement in the Biden-Harris administration’s final year, with outcomes likely influencing pending deals like Unilever’s rumored bid for Hormel[5][16]. While the companies’ complementary portfolios suggest probable Phase I clearance, regulators’ newfound focus on nutritional impact and private label competition could present challenges.

Sources

https://www.gurufocus.com/news/2872686/mars-36-billion-acquisition-of-kellanova-awaits-eu-antitrust-decision-chk-stock-news, https://economictimes.com/news/international/business/eu-to-rule-by-june-25-on-mars-36-billion-pringles-maker-kellanova-takeover/articleshow/121265824.cms, https://www.mars.com/news-and-stories/press-releases-statements/mars-acquisition-august-2024, https://www.campaignlive.com/article/mars-acquire-pringles-maker-kellanova-one-largest-buyouts-packaged-goods-history/1885214, https://www.pymnts.com/cpi-posts/eu-antitrust-regulators-push-back-deadline-on-unicredits-takeover-bid-for-banco-bpm/, https://www.fi-desk.com/mars-issues-us26-billion-to-acquire-kellanova/, https://www.kavout.com/market-lens/mars-36-billion-acquisition-of-kellanova-how-it-could-reshape-the-snack-industry, https://www.marketingweek.com/kellogg-company-kellanova-brand/, https://www.storyboard18.com/how-it-works/eu-antitrust-ruling-on-mars-36-billion-kellanova-takeover-due-by-june-25-66367.htm, https://www.globalbankingandfinance.com/UK-KELLANOVA-M-A-MARS-EU-62d8583c-5695-4450-9883-8a9f8158a90c, https://www.youtube.com/watch?v=oEfB6wLYpyI, https://www.foodandpower.net/latest/mars-kellanova-deal-aug-24, https://nicolasmurat.substack.com/p/digging-into-the-mars-kellanova-deal-836, https://eu-cap-network.ec.europa.eu/sites/default/files/publications/2024-12/eu-cap-network-assessment-of-results-based-interventions-twg7.pdf, https://competition-policy.ec.europa.eu/mergers/procedures_en, https://www.checkout.ie/a-brands/mars-to-buy-kellanova-for-36bln-in-2024s-biggest-deal-212509, https://www.futureofsnacking.com/media/aremdsjq/kellanova-acquisition_microsite-faq_final_081424.pdf, https://seekingalpha.com/news/4450044-kellanova-edges-higher-as-eu-sets-june-25-deadline-for-mars-deal, https://www.mlex.com/mlex/dealrisk/articles/2341804/mars-files-kellanova-takeover-for-eu-competition-approval