Key findings from the sources:

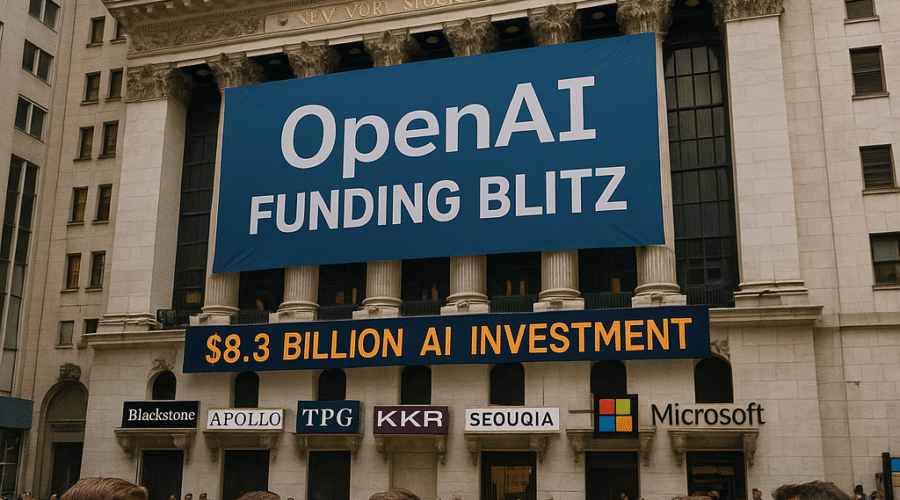

1. OpenAI raised $8.3B at $300B valuation, ahead of schedule [1][7][13]

2. Dragoneer Investment Group led with $2.8B – massive single check [1][14]

3. New institutional investors: Blackstone, TPG, T. Rowe Price [1][7][13]

4. Part of broader $40B fundraising strategy announced in March [1][2]

5. Revenue acceleration: $13B annually, up from $10B in June [1][14]

6. Round was 5x oversubscribed [13][14]

7. Early investors got smaller allocations to make room for new strategic backers [14]

8. Company pursuing for-profit transition and eventual IPO [11][14]

I need to structure this as an executive-level analysis covering:

– Deal mechanics and investor composition

– Strategic rationale behind Wall Street’s AI infrastructure bet

– Valuation analysis and financial metrics

– Corporate structure evolution toward IPO

– Broader sector implications for private equity and M&A

The personalization requires HTML5 format, WSJ-style writing, SEO optimization with long-tail keywords, and infographic suggestions for C-level comprehension.

Let me create a comprehensive article that analyzes this funding round from an M&A and private equity perspective, incorporating relevant SEO terms naturally while maintaining executive readability.

OpenAI’s latest $8.3 billion funding round, completed months ahead of schedule and led by a record-breaking $2.8 billion commitment from Dragoneer Investment Group, signals a decisive shift in how institutional capital is approaching artificial intelligence infrastructure investments. The round, which achieved a $300 billion valuation and attracted heavyweight private equity firms Blackstone and TPG alongside established technology investors, represents far more than another Silicon Valley funding milestone—it demonstrates Wall Street’s growing conviction that AI infrastructure represents a generational investment opportunity comparable to the early internet buildout of the late 1990s.

💼 M&A / PE diligence in 24 hours? Yes, thanks to AI!

Deal Structure and Investor Composition Signal Strategic Realignment

The $8.3 billion tranche, which forms part of OpenAI’s broader $40 billion fundraising strategy announced in March 2025, was oversubscribed by a factor of five, forcing the company to prioritize new strategic investors over existing backers[13][14]. This dynamic reflects the intense competition among institutional investors to secure positions in what many consider the most promising artificial intelligence platform company globally. Dragoneer Investment Group’s $2.8 billion commitment represents roughly 10% of the firm’s total assets under management, underscoring the magnitude of conviction required to lead such a substantial round[1][14].

The investor composition reveals a deliberate strategy to broaden OpenAI’s institutional support beyond traditional venture capital. Private equity titans Blackstone and TPG joined the round alongside mutual fund manager T. Rowe Price, marking their first direct investments in OpenAI and signaling broader institutional acceptance of artificial intelligence as a core infrastructure play[1][7]. This expansion beyond venture capital into private equity and public markets funding sources positions OpenAI for its anticipated transition to public company status while providing access to the deeper capital pools necessary for its ambitious infrastructure investments.

Traditional technology investors including Andreessen Horowitz, Sequoia Capital, Fidelity Management, Tiger Global, and Thrive Capital participated alongside the newcomers, though several early investors reportedly received smaller allocations than desired to accommodate the strategic priority placed on attracting new institutional partners[14]. This rebalancing of the investor base reflects OpenAI’s evolution from a venture-backed startup to a pre-public technology infrastructure company requiring diverse funding sources and strategic relationships across multiple market segments.

Revenue Acceleration and Financial Metrics Drive Valuation Premium

OpenAI’s financial performance provides substantial justification for its $300 billion valuation, with annual recurring revenue reaching $13 billion as of August 2025, representing a 30% increase from the $10 billion reported just two months earlier[1][14]. The company now serves five million paying business customers, doubling from three million in recent months, while ChatGPT maintains approximately 700 million weekly active users across its free and premium tiers[7]. Revenue projections suggest the company could exceed $20 billion in annual recurring revenue by year-end 2025, putting it on a trajectory toward $100 billion in revenue by 2029 according to internal forecasts[5][14].

The valuation multiple of approximately 13.5 times forward revenue places OpenAI in line with high-growth software companies at their initial public offering stages, comparable to Facebook’s IPO valuation metrics[5]. However, unlike traditional software businesses where marginal costs decrease with scale, OpenAI’s compute-intensive business model maintains significant variable costs tied to inference and training operations. The company expects to invest $5 billion in compute infrastructure during 2025 while generating $3.7 billion in revenue, highlighting the capital-intensive nature of artificial intelligence platform development[5].

Despite current losses projected at $5 billion for 2025, investors are betting on OpenAI’s ability to achieve operating leverage as its models become more efficient and enterprise adoption accelerates. The company’s gross margins are expected to improve as newer model architectures reduce inference costs while premium enterprise services command higher pricing. This trajectory aligns with historical precedents in cloud computing, where initial infrastructure investments eventually yielded substantial returns as utilization rates increased and unit economics improved.

Infrastructure Investment Thesis Attracts Private Equity Capital

Blackstone’s participation in the OpenAI funding round aligns with the private equity giant’s broader artificial intelligence infrastructure investment strategy, which includes major positions in data center operators QTS and AirTrunk, renewable energy provider Invenergy, and GPU cloud computing company CoreWeave[4]. The firm’s systematic approach to AI infrastructure investments reflects recognition that artificial intelligence requires massive physical infrastructure deployments comparable to previous technology platform shifts, creating opportunities for private equity to deploy capital across the entire value chain from power generation to data centers to specialized computing resources.

The convergence of data center demand, power consumption requirements, and artificial intelligence computing needs has created what Blackstone characterizes as a “generational investment opportunity” with multi-decade growth potential[4]. Global data creation continues doubling every three years, while AI workloads require significantly more computing power per transaction than traditional cloud applications, driving exponential demand for specialized infrastructure. This dynamic has attracted private equity firms seeking long-duration, inflation-protected assets with predictable cash flows tied to technology platform adoption.

TPG’s participation alongside Blackstone indicates broader private equity industry recognition that artificial intelligence infrastructure investments offer attractive risk-adjusted returns with limited correlation to traditional market cycles. The sector’s capital intensity creates natural barriers to entry while demand visibility extends across multiple years as enterprises integrate AI capabilities into core business processes. For private equity firms managing increasingly large fund sizes, AI infrastructure provides the scale and duration characteristics necessary to deploy substantial capital efficiently.

The inclusion of T. Rowe Price and Fidelity Management demonstrates that mutual fund managers are also viewing OpenAI as a core technology infrastructure holding suitable for public market-oriented portfolios. This crossover appeal between private and public market investors positions OpenAI advantageously for its eventual initial public offering while providing access to diverse funding sources as it scales operations globally.

Stargate Initiative Drives Enterprise AI Infrastructure Buildout

OpenAI’s fundraising directly supports its Stargate initiative, a joint venture with SoftBank, Oracle, and NVIDIA targeting up to $500 billion in AI infrastructure investments through 2029[1]. This massive infrastructure program encompasses data center construction across the United States, United Arab Emirates, and Europe, including a 100,000 GPU facility in Norway powered entirely by renewable energy. The scale of infrastructure investment required to support advanced AI model training and deployment represents one of the largest technology buildouts in history, comparable to the global fiber optic network expansion of the early 2000s.

The Stargate program addresses fundamental bottlenecks in AI model development, particularly the availability of specialized computing resources and the power infrastructure necessary to support large-scale training operations. Current GPU availability constraints limit the pace at which AI companies can develop and deploy new models, creating competitive advantages for organizations with dedicated infrastructure access. OpenAI’s partnership approach with established infrastructure providers like Oracle demonstrates recognition that building proprietary data centers requires expertise and capital beyond the capabilities of most technology companies.

Microsoft’s commitment to spend $80-110 billion on AI infrastructure in 2025 alone illustrates the magnitude of investment required to support advanced AI systems[5]. The company is constructing computing clusters with 100,000 GPUs and planning facilities consuming one gigawatt of power by 2026, with requirements potentially reaching multiple gigawatts by 2028. These infrastructure demands create opportunities for private equity firms and infrastructure investors to participate in the AI value chain through strategic partnerships and joint ventures rather than direct technology investments.

Corporate Structure Evolution Prepares for Public Market Transition

OpenAI’s current funding round occurs amid the company’s planned transition from its unique nonprofit-controlled structure to a Delaware Public Benefit Corporation, positioning it for eventual public market access[11]. The proposed restructuring would convert the existing for-profit subsidiary into a traditional corporation with standard equity shares while maintaining the nonprofit organization as a separate entity focused on charitable initiatives in healthcare, education, and scientific research. This structural evolution addresses investor concerns about governance and control while preserving OpenAI’s mission-driven orientation.

The corporate restructuring process requires careful navigation of regulatory requirements and stakeholder interests, particularly given Microsoft’s significant investment and partnership agreements with OpenAI. Current licensing arrangements exempt artificial general intelligence systems from Microsoft’s commercial access, creating potential complications as the company approaches technical milestones that could trigger these provisions[11]. The restructuring aims to clarify these relationships while providing conventional investment terms that facilitate additional capital raising and eventual public market access.

Private equity and institutional investors participating in the current round are betting that OpenAI’s restructuring will unlock substantial value through improved governance structures and clearer paths to liquidity. The company’s massive scale and market leadership position in artificial intelligence platform services make it an attractive IPO candidate, potentially achieving one of the largest technology public offerings in history. However, the timing of public market access depends on completing the corporate restructuring and demonstrating sustainable profitability metrics that satisfy public market investors.

The Delaware Public Benefit Corporation structure provides flexibility to balance commercial objectives with broader societal considerations, addressing concerns from employees and researchers about the company’s mission orientation. This approach has precedent with other AI companies including Anthropic and xAI, though OpenAI’s unique nonprofit heritage requires more complex transition planning than pure venture-backed startups typically face.

Competitive Landscape and Market Positioning Analysis

OpenAI’s $300 billion valuation significantly exceeds its nearest competitors, with Anthropic valued at $61.5 billion as of March 2025 despite pursuing additional funding at a potential $170 billion valuation[14]. Elon Musk’s xAI has achieved an $80 billion valuation through $10 billion in funding, though reports suggest current fundraising efforts could reach $200 billion. These valuations reflect investor belief that artificial intelligence platform markets will support multiple large-scale winners, similar to cloud computing where Amazon, Microsoft, and Google all achieved substantial market capitalizations despite competing directly.

The competitive dynamics favor companies with early market leadership and substantial compute infrastructure investments, creating natural advantages for organizations that can achieve scale efficiently. OpenAI’s first-mover advantage in conversational AI and enterprise adoption provides defensive moats that justify premium valuations, while newer entrants face significant catch-up investments in model development and infrastructure deployment. This dynamic attracts private equity investors seeking positions in market leaders with established competitive advantage

Sources

https://www.maginative.com/article/openai-raises-8-3b-toward-its-40b-fundraise/, https://techcrunch.com/2025/03/31/openai-raises-40b-at-300b-post-money-valuation/, https://www.mitrade.com/au/insights/news/live-news/article-3-1005891-20250801, https://www.blackstone.com/investing-in-ai/, https://foundationcapital.com/why-openais-157b-valuation-misreads-ais-future/, https://www.implicator.ai/openai-raises-8-3-billion-as-wall-street-bets-on-ai-infrastructure/, https://techcrunch.com/2025/08/01/openai-reportedly-raises-8-3b-at-300b-valuation/, https://openai.com/index/march-funding-updates/, https://investingnews.com/opentext-to-acquire-micro-focus-international-plc/, https://deepsense.ai/wp-content/uploads/2023/03/2302.07730.pdf, https://techcrunch.com/2024/12/27/openai-lays-out-its-for-profit-transition-plans/, https://www.mitrade.com/insights/news/live-news/article-3-1005891-20250801, https://www.investing.com/news/stock-market-news/openai-raises-83-billion-at-300-billion-valuation-exceeding-target--nyt-4165906, https://fortune.com/2025/08/01/openai-funding-oversubscribed-early-investors-new-partners-dragoneer/, https://www.tradingview.com/news/reuters.com,2025:newsml_FWN3TT1D5:0-openai-has-raised-8-3-billion-at-a-300-billion-valuation-months-ahead-of-schedule-nyt-dealbook/, https://breakingthenews.net/Article/OpenAI-said-to-raise-over-dollar8B-in-latest-funding-round/64574558, https://www.marketscreener.com/news/openai-has-raised-8-3-billion-at-a-300-billion-valuation-months-ahead-of-schedule-nyt-dealbook-ce7c5fd2d080f022, https://www.aitechsuite.com/ai-news/openai-secures-83-billion-rockets-to-300-billion-valuation-in-ai-race