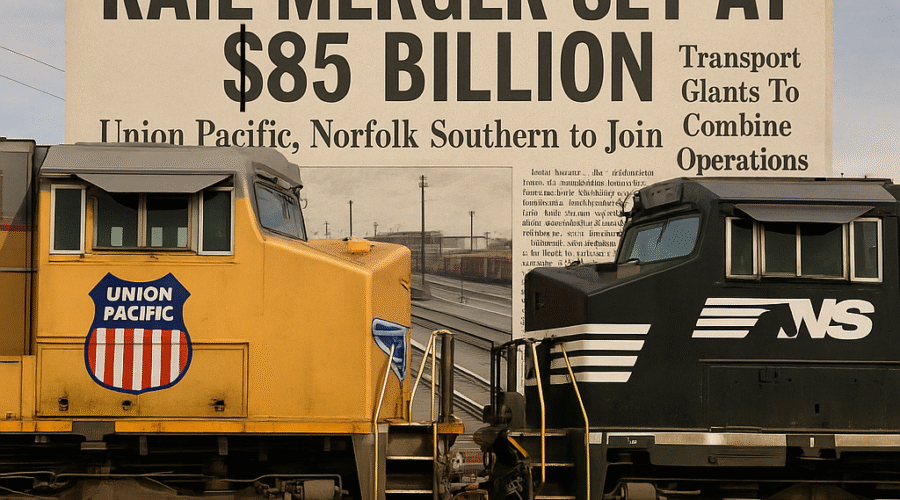

Union Pacific’s proposed acquisition of Norfolk Southern, valued at $85 billion and poised to create America’s first transcontinental railroad, faces significant opposition from the nation’s largest rail union. The SMART Transportation Division has announced plans to formally contest the merger during regulatory proceedings, citing concerns about workforce impacts, safety standards, and long-term industry health. This development introduces critical uncertainty to a deal that would reshape North American freight logistics.

💼 M&A / PE diligence in 24 hours? Yes, thanks to AI!

The Merger’s Strategic Ambitions

Union Pacific’s bid to acquire Norfolk Southern represents the most ambitious consolidation in U.S. rail history, combining two Class I railroads into a single entity spanning 52,215 route miles across 43 states. The merged network would connect Union Pacific’s western infrastructure with Norfolk Southern’s eastern operations, creating seamless coast-to-coast freight capabilities[3][11][17].

Operational Synergies and Economic Impact

The companies project $2.75 billion in annual synergies within three years, achieved through $1.75 billion in revenue growth and $1 billion in cost savings. Key benefits include eliminating interchange delays between networks, expanding intermodal services, and reducing transit times on critical corridors like Pittsburgh-to-Colton steel shipments and Gulf Coast plastics to Midwest markets[11][14][20].

Proponents argue the merger would strengthen U.S. manufacturing competitiveness by enabling more efficient movement of commodities such as lumber, copper, and agricultural products. The combined entity would serve approximately 100 ports, enhancing global trade capabilities[11][17][20].

Union Opposition and Workforce Concerns

SMART Transportation Division, representing 40,000 rail workers, has emerged as the merger’s most formidable opponent. The union cites historical precedents where consolidation led to workforce reductions and service quality declines, particularly following Union Pacific’s 1996 merger with Southern Pacific[1][7][19].

Key Concerns Raised by SMART

The union’s opposition centers on four critical areas:

1. **Job Security**: Preservation of union positions across both railroads, with concerns about potential layoffs despite company assurances of job growth[1][7][17].

2. **Safety Standards**: Implementation of integrated safety protocols across merged operations, referencing past challenges in post-merger safety integration[12][19].

3. **Service Quality**: Risks of reduced competition leading to diminished service responsiveness, particularly for agricultural and industrial shippers[13][19].

4. **Regulatory Scrutiny**: Calls for rigorous Surface Transportation Board (STB) review under updated 2001 merger guidelines that prioritize public interest over corporate consolidation[18][19].

Regulatory Hurdles and Precedents

The STB faces a complex review process under its 2001 merger rules, which require demonstrating enhanced competition and public benefits. The Canadian Pacific-Kansas City Southern merger took two years to approve, setting a precedent for prolonged scrutiny[10][18].

Key Regulatory Considerations

1. **Environmental Impact**: Comprehensive assessment of increased rail traffic on communities and infrastructure, with potential mitigation requirements[10][18].

2. **Competition Analysis**: Evaluation of market concentration risks, particularly in regions where the merged entity would dominate freight corridors[13][18].

3. **Safety Integration Plans**: Development of protocols for merging operational practices, including training programs and equipment maintenance standards[12][18].

Economic and Industry Implications

The merger’s success could trigger a new wave of consolidation among remaining Class I railroads. BNSF (Berkshire Hathaway) and CSX may face pressure to pursue acquisitions to maintain competitive parity, particularly in intermodal and transcontinental services[14][20].

Financial and Operational Metrics

The combined entity would achieve:

• **Revenue**: $36 billion annually

• **EBITDA**: $18 billion

• **Operating Ratio**: 62% (industry benchmark)

• **Free Cash Flow**: $7 billion[11][15]

Union Pacific’s stock rose marginally post-announcement, while Norfolk Southern shares dipped 2.6%, reflecting market skepticism about regulatory approval[6][14].

Strategic Recommendations for Stakeholders

1. **Investors**: Monitor STB proceedings and union negotiations, as approval timelines and conditions could impact valuation[18][20].

2. **Shippers**: Engage with regulators to ensure service quality commitments, particularly for time-sensitive agricultural and automotive shipments[13][19].

3. **Regulators**: Prioritize workforce protections and competitive safeguards, drawing from lessons of past rail consolidations[12][18].

Conclusion

Union Pacific’s transcontinental vision faces a pivotal test as SMART’s opposition amplifies regulatory and operational risks. While the merger promises transformative economic benefits, its success hinges on addressing union concerns and navigating STB’s rigorous review process. The outcome will determine whether this consolidation becomes a landmark in rail industry evolution or a cautionary tale of overreach.

Sources

https://www.aol.com/largest-u-rail-union-intends-145458294.html, https://en.wikipedia.org/wiki/Union_Pacific_Railroad, https://investor.unionpacific.com/news-releases/news-release-details/union-pacific-and-norfolk-southern-create-americas-first, https://www.investing.com/news/stock-market-news/union-pacifics-85-billion-norfolk-southern-bid-faces-rail-union-opposition-93CH-4157972, https://www.lawforpeople.com/blog/largest-railroads-in-north-america/, https://www.ttnews.com/articles/ns-up-railroad-merger, https://seekingalpha.com/news/4473444-largest-rail-union-will-oppose-union-pacifics-deal-for-norfolk-southern, https://www.up.com, https://kfgo.com/2025/07/29/largest-u-s-rail-union-intends-to-oppose-norfolk-southern-and-union-pacific-merger/, https://www.stb.gov/news-communications/latest-news/pr-23-07/, https://www.freightwaves.com/news/union-pacific-and-norfolk-southern-reach-85-billion-merger-deal, https://railroads.dot.gov/elibrary/federal-railroad-administration-issues-final-rule-regarding-safety-integration-planning, https://www.dtnpf.com/agriculture/web/ag/columns/cash-market-moves/article/2025/07/28/union-pacific-norfolk-southern, https://www.ksby.com/business/company-news/union-pacific-announces-20-billion-bid-for-norfolk-southern-to-create-transcontinental-railroad, https://www.youtube.com/watch?v=SV8-fd4-qPg, https://www.tradingview.com/news/reuters.com,2025:newsml_L6N3TQ0PP:0-largest-u-s-rail-union-intends-to-oppose-norfolk-southern-and-union-pacific-merger/, https://www.up.com/news/growth/union-pacific-transcontinental-railroad-it-250729, https://www.freightwaves.com/news/stb-creates-rail-merger-resource-pages, https://www.smart-union.org/about-smart/, https://www.foxbusiness.com/lifestyle/union-pacific-norfolk-southern-merge-creating-first-us-transcontinental-railroad