Alimentation Couche-Tard’s abrupt withdrawal from its $46 billion bid for Seven & i Holdings marks one of the most significant M&A failures in recent retail history, exposing deep-seated cultural resistance to foreign takeovers in Japan and strategic misalignments in global convenience retail consolidation. The collapsed deal—which would have created a 104,000-store global powerhouse—reveals enduring governance challenges in cross-border transactions and reshapes competitive dynamics in the $1.3 trillion convenience retail sector. Market reactions were immediate and severe, with Seven & i shares plunging 9.6% as investors priced in the loss of premium valuation, while Couche-Tard’s stock surged 13% on relief over avoiding an overextended acquisition[1][7][6][17].

💼 M&A / PE diligence in 24 hours? Yes, thanks to AI!

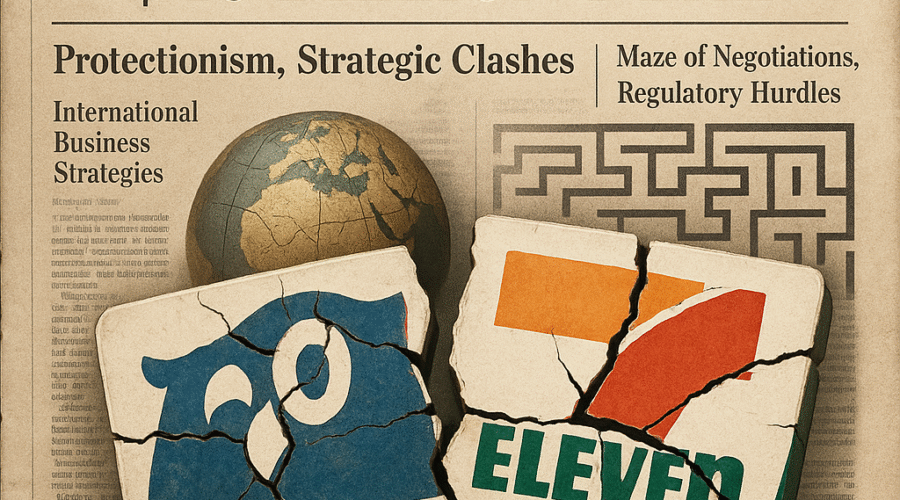

The Anatomy of a Failed Megadeal

Strategic Ambitions vs. Defensive Posturing

Couche-Tard’s pursuit of Seven & i began in July 2024 as a bold consolidation play to dominate global convenience retailing, offering a 47.6% premium at ¥2,600 per share. The Canadian retailer envisioned leveraging Seven & i’s 85,000 stores—particularly its North American 7-Eleven footprint—to achieve unprecedented scale advantages in procurement, private label development, and fuel distribution[7][15][19]. However, Seven & i’s board consistently framed the bid as undervaluing its “crown jewel” North American operations while exaggerating antitrust risks, despite Couche-Tard’s commitment to divest 2,000 U.S. stores to preempt regulatory concerns[9][15][18]. This fundamental valuation gap was compounded by Seven & i’s defensive maneuvers: appointing its first foreign CEO (Stephen Dacus), accelerating a ¥2 trillion ($14.2 billion) share buyback, and announcing plans to spin off its U.S. division via IPO—all tactics interpreted by Couche-Tard as deliberate stalling rather than good-faith negotiation[1][2][19].

The Breaking Point: Due Diligence Sabotage

After signing a non-disclosure agreement in April 2025, Couche-Tard encountered what it termed “a calculated campaign of obfuscation” from Seven & i management. Critical data requests yielded only publicly available information, while management meetings were tightly scripted affairs where executives were discouraged from substantive dialogue. In one Dallas meeting, CEO Dacus visibly interrupted a subordinate attempting to answer licensing questions, making a pointed gesture to his head—an incident Couche-Tard cited as emblematic of the board’s obstructive posture[9][17]. This stonewalling persisted despite Couche-Tard’s compromise proposal to acquire 100% of Seven & i’s international business and 40% of its Japanese operations, leaving majority domestic control with existing shareholders[9][15].

Cultural and Structural Barriers to Cross-Border M&A

The “Moat of Japanese Protectionism”

Andrew Jackson of Ortus Advisors accurately diagnosed the core impediment as “the moat of Japanese protectionism,” where corporate boards prioritize stability and national identity over shareholder returns. This manifested through the influential Ito family’s refusal to engage with Couche-Tard despite controlling just 5% equity—a reflection of Japan’s stakeholder capitalism model that privileges management continuity and employee interests[1][5][15]. The Japanese government further weaponized “national security” concerns, citing 7-Eleven stores’ role in disaster relief, despite the chain’s minimal strategic importance compared to sectors like semiconductors or energy[5][15]. These dynamics persist despite Japan’s 2024 corporate governance reforms aimed at attracting foreign investment, revealing the gap between policy and boardroom reality.

Antitrust Misalignment and Regulatory Theater

Seven & i consistently cited U.S. antitrust hurdles as a primary deal risk, yet documentation shows Couche-Tard proactively collaborated on store divestitures. Potential buyers for 2,000 North American locations emerged, but Seven & i withheld essential operational data needed for binding offers—a tactic Couche-Tard interpreted as bad-faith obstruction[9][15][18]. Ironically, the Federal Trade Commission had recently approved Couche-Tard’s acquisition of Giant Eagle’s convenience stores with only 35 station divestitures, suggesting manageable regulatory risk for the 7-Eleven transaction[4]. This regulatory posturing masked Seven & i’s fundamental resistance to foreign control of a cultural icon, with convenience stores (“konbini”) representing not just commerce but social infrastructure in Japan[5][19].

Market Fallout and Strategic Implications

Investor Reckoning and Valuation Reset

The deal’s collapse triggered an immediate 9.6% plunge in Seven & i shares to ¥2,007.5—23% below Couche-Tard’s offer price—erasing $4.3 billion in market value as investors priced in diminished growth prospects[7][15][17]. Activist shareholders like Maso Capital expressed frustration at the board’s “lack of willingness to engage,” noting the bid represented a rare opportunity to monetize Seven & i’s stagnant domestic operations[18][19]. Conversely, Couche-Tard’s stock surged 13% as markets applauded fiscal discipline, with the company announcing a C$4.2 billion share buyback to redeploy capital[6][10]. This divergence underscores the market’s verdict: Seven & i’s defensive tactics preserved independence at the cost of shareholder value, while Couche-Tard avoided overpayment for a business facing structural headwinds in its core Japanese market.

Seven & i’s Precarious Standalone Path

With the white-knight bid withdrawn, Seven & i faces intensified pressure to execute its standalone strategy. The planned U.S. IPO—originally a poison pill against acquisition—now appears economically unnecessary without takeover pressure, with Aizawa Securities’ Ikuo Mitsui noting “no reason to list the crown jewel” after Couche-Tard’s exit[2][19]. The company’s August 2025 strategy update becomes critical for justifying its three-pillar plan: (1) monetizing the superstore division via $5.4 billion sale to Aeon, (2) expanding high-margin private label offerings, and (3) digitalizing 7-Eleven Japan’s aging store network[1][17]. However, BI analyst Lea El-Hage warns that achieving Couche-Tard’s offered premium organically would require doubling Seven & i’s operating margin to 8%—a near-impossible feat given its 2.3% same-store sales decline in Japan[1][17].

Broader Lessons for Global Retail M&A

Governance Pitfalls in Cross-Border Deals

This failed transaction exposes critical governance flaws in Japanese corporate defense mechanisms. Seven & i’s special committee—tasked with evaluating the bid—proved functionally impotent against board-level resistance, with Couche-Tard’s due diligence requests ignored despite NDA protections[9][15]. The Ito family’s ability to veto negotiations despite minority ownership highlights the disproportionate influence of founding dynasties in Japanese capitalism, undermining shareholder democracy[14][15]. For foreign acquirers, this case establishes that hostile approaches remain virtually impossible in Japan, requiring near-unanimous board approval before due diligence access—a structural disadvantage unlikely to change without regulatory intervention.

Consolidation Realities in Fragmented Markets

The collapse leaves the global convenience sector bifurcated: Couche-Tard retains dominance in fuel-centric Western markets with 17,000 Circle K locations, while Seven & i controls Asia’s premium urban store network. This outcome delays industry consolidation needed to counter Amazon’s convenience incursions and margin pressure from delivery apps. With regulatory barriers now clearer, future deals will likely target smaller regional players—such as Couche-Tard’s rumored interest in Turkey’s BIM—rather than transformative national champions[10][15]. For private equity, the lesson is stark: Japanese megadeals require not just financing but cultural capitulation, making minority stakes (like KKR’s 15% investment in Seiyu) the only viable entry model.

Conclusion: Strategic Crossroads for Retail Titans

Couche-Tard’s withdrawal crystallizes the limits of global retail consolidation in protectionist markets, forcing both companies onto divergent paths. Seven & i must now validate its $40 billion standalone valuation through a U.S. IPO that markets may reject as superfluous, while accelerating Japan’s store modernization against demographic decline[2][17]. For Couche-Tard, the $4.2 billion buyback signals a pivot toward organic growth and bolt-ons in receptive markets—a prudent retreat from transformational ambitions. The saga’s enduring lesson is that in cross-border M&A, cultural and governance barriers can prove more formidable than financing or antitrust—a reality requiring acquirers to preemptively address stakeholder nationalism through local partnerships and phased integration. As global retail enters its next consolidation phase, this failed megadeal will stand as a cautionary tale of ambition colliding with institutional resistance.

Sources

https://theedgemalaysia.com/node/762938, https://theedgemalaysia.com/node/762996, https://www.eurokor.si/ariana-grande-teases-upcoming-tour-says-music-still-her-lifeline-1738658, https://www.marketbeat.com/stocks/TSE/ATD/news/, https://www.youtube.com/watch?v=eNq52l2aKfs, https://www.bnnbloomberg.ca/business/company-news/2025/07/17/couche-tard-shares-jump-more-than-10-after-walking-away-from-7-eleven-offer/, https://www.morningstar.com/news/dow-jones/202507169656/seven-i-shares-slump-after-couche-tard-abandons-47-billion-bid, https://www.japantimes.co.jp/business/2025/07/17/companies/couche-tard-abandons-seven/, https://www.bluebookservices.com/alimentation-couche-tard-backs-out-of-takeover-bid-for-7-eleven-owner/, https://www.investing.com/news/stock-market-news/canadas-couchetard-resumes-share-buyback-after-scrapping-seven--i-acquisition-bid-4143977, https://www.youtube.com/watch?v=a5eKkL9dJCQ, https://www.morningstar.com/news/dow-jones/202507169656/seven-i-shares-slump-after-couche-tard-abandons-47-billion-bid, https://www.marketscreener.com/quote/stock/SEVEN-I-HOLDINGS-CO-LTD-6497950/news/Seven-I-Shares-Slump-After-Couche-Tard-Abandons-47-Billion-Bid-50529550/, https://financialpost.com/pmn/business-pmn/seven-i-shares-plunge-after-management-buyout-collapses, https://www.marketscreener.com/quote/stock/ALIMENTATION-COUCHE-TARD--143457395/news/Couche-Tard-scraps-46-billion-bid-for-Japan-s-Seven-i-50528991/, https://www.instagram.com/nikkeiasia/p/DG2Lj5otBUf/?locale=uken1, https://financialpost.com/pmn/business-pmn/couche-tard-abandons-46-billion-bid-to-acquire-seven-i, https://ktvz.com/money/cnn-business-consumer/2025/07/16/canadian-retail-giant-scraps-47-billion-bid-for-7-eleven-owner/, https://www.malaymail.com/news/money/2025/07/17/7-eleven-owner-shares-tumble-9pc-after-couche-tard-drops-takeover/184182, https://www.youtube.com/watch?v=TMtFMENXtz8, https://content.next.westlaw.com/Document/I16ce4a40629611f09052b7eae13837bd/View/FullText.html?transitionType=Default&contextData=%28sc.Default%29