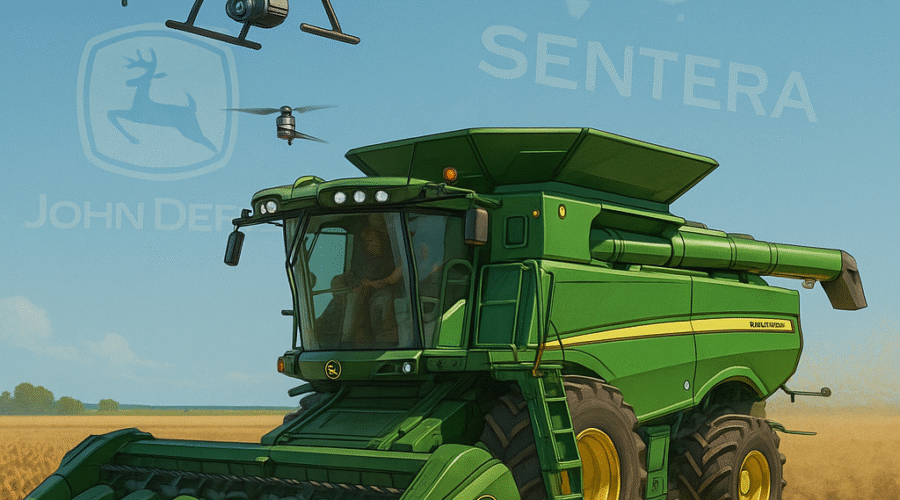

In a landmark move for agricultural technology, John Deere announced its acquisition of Sentera on May 23, 2025, marking a pivotal step in advancing data-driven farming solutions. The $140 billion machinery giant’s integration of Sentera’s drone-based remote imagery systems strengthens its position as a leader in precision agriculture, offering farmers granular field insights through high-resolution crop health analytics, targeted herbicide prescriptions, and seamless compatibility with existing farm management platforms. This strategic alignment accelerates John Deere’s vision of enabling farmers to “do more with less” while addressing critical challenges in resource optimization and sustainability[2][9][17].

💼 Seasoned CorpDev / M&A / PE expertise

Sentera’s Technological Edge: From Drone Sensors to Decision-Making

High-Resolution Imaging and FieldAgent Analytics

Sentera’s multispectral sensors, including the Double 4K and 6X models, capture RGB, near-infrared (NIR), and red-edge spectral data at resolutions as fine as 0.45 cm/pixel[14][15]. These sensors integrate with major drone platforms like DJI and Freefly Astro, enabling rapid aerial surveys that map weed pressure, crop stand uniformity, and disease hotspots across thousands of acres[1][5]. The FieldAgent software suite processes this imagery into actionable insights, generating stand count reports, tassel development metrics, and nitrogen stress maps within minutes of data capture[11][19]. For example, SmartScript Weeds identifies herbicide-resistant species like Palmer amaranth and waterhemp, creating prescription maps that reduce chemical usage by 30–50% compared to broadcast spraying[12][17].

Interoperability with John Deere’s Ecosystem

The acquisition bridges Sentera’s analytics with John Deere’s Operations Center, allowing farmers to wirelessly transmit weed maps and nutrient prescriptions to compatible equipment like ExactApply sprayers and See & Spray™ systems[5][13]. This integration eliminates manual data transfer delays, enabling real-time adjustments during field operations. As Nick Einck, Director of Agronomy at Chandler Coop, noted: “Sentera’s scouting solutions allow us to customize our approach per field while leveraging existing John Deere technologies for unmatched efficiency”[9][20]. Crucially, John Deere will maintain an open platform, ensuring third-party drone providers retain access to Operations Center—a strategic nod to customer flexibility[6][19].

Strategic Rationale: Synergies and Market Positioning

Expanding John Deere’s Precision Ag Portfolio

This acquisition complements John Deere’s $300 million purchase of Blue River Technology (2017) and its recent investments in autonomous tractors. Sentera’s focus on plant-level analytics fills a critical gap in John Deere’s suite, particularly for mid-sized farms adopting precision tools incrementally[9][17]. By offering scalable solutions—from basic stand count reports to advanced resistance management—the deal positions John Deere to serve 85% of U.S. row-crop farmers currently using drones for scouting[8][18].

Financial and Operational Synergies

With a 24% return on equity and $12.3 billion in operating cash flow (2024), John Deere leverages its financial strength to absorb Sentera’s 122-employee team and R&D pipeline[7][18]. The integration avoids redundancies by retaining Sentera’s St. Paul headquarters as a center of excellence for aerial analytics while folding sales and support into John Deere’s global network[2][9]. Early projections suggest the deal could add $150–200 million annually to John Deere’s precision ag revenue by 2027, driven by cross-selling to Sentera’s existing enterprise clients like Bayer and Corteva[3][6].

Industry Implications: Accelerating the Data-Driven Farm

Competitive Landscape Shift

John Deere’s move counters CNH Industrial’s partnership with AgEagle and AGCO’s acquisition of Precision Planting. By controlling both hardware (sensors) and software (FieldAgent), John Deere gains an edge in closed-loop systems where data collection informs equipment automation—a key differentiator as farmers prioritize input cost savings amid volatile commodity markets[5][17]. However, the open-platform approach risks ceding analytics opportunities to rivals like DroneDeploy, which supports 200+ drone models[19].

Sustainability and Regulatory Tailwinds

Sentera’s precision spraying tools align with EPA mandates to reduce atrazine runoff by 40% by 2030. Early adopters report 15–20% lower herbicide costs and 50% fewer resistance issues—critical as 73% of U.S. farms grapple with glyphosate-resistant weeds[12][17]. Additionally, the USDA’s Climate-Smart Commodities program could incentivize Sentera’s carbon sequestration analytics, which track cover crop biomass and tillage impacts[8][15].

Implementation Challenges and Risks

Data Integration Complexities

While Operations Center supports Sentera’s .tiff and .shp files, legacy John Deere users must adapt to FieldAgent’s API-driven workflows. Pilot programs in Iowa and Minnesota reveal a 3–6 month learning curve for agronomists transitioning from manual scouting[11][19]. Compatibility issues also persist with older sprayers lacking individual nozzle control, limiting SmartScript adoption to 35% of John Deere’s installed base[12][13].

Market Saturation Concerns

With Sentera already serving 740,000 acres via enterprise contracts, growth depends on penetrating small-scale operations—a segment where DJI’s $1,500 Agras T30 drone dominates[14][18]. John Deere’s dealer network must balance promoting Sentera’s $1,000–$1,500 software tiers against lower-cost alternatives like Pix4D Fields[10][20].

The Road Ahead: Scaling Innovation

John Deere plans to debut Sentera-powered bundled subscriptions in Q4 2025, combining sensor rentals, cloud analytics, and equipment discounts. Early prototypes of the 65R global shutter sensor—paired with See & Spray Ultimate—demonstrate 95% accuracy in differentiating crops from weeds at 15 mph application speeds[14][15]. As CEO Brian Wenngatz emphasized: “This partnership isn’t about replacing agronomists; it’s about arming them with hyperlocal insights no human scout could capture”[6][16].

For investors, the deal underscores John Deere’s shift from machinery sales to data-as-a-service—a transition reflected in its 18% CAGR for precision ag revenue since 2020[7][18]. Farmers gain a turnkey solution to navigate labor shortages and sustainability pressures, while Sentera’s team secures R&D resources to advance edge-computing and AI-driven anomaly detection[8][11]. In an era where every plant counts, this acquisition redefines what’s possible at the intersection of agronomy and technology.

Sources

https://dronexl.co/2025/05/23/john-deere-acquires-sentera-agriculture/, https://www.startribune.com/this-st-paul-tech-firm-which-helps-farmers-with-drones-was-just-bought-by-john-deere/601360499, https://agfunder.com/portfolio/sentera/, https://www.suasnews.com/2016/05/sentera-brings-precision-scouting-capabilities-dji-phantom-4-drone/, https://kfgo.com/2025/05/23/john-deere-acquires-sentera-to-integrate-aerial-field-scouting/, https://www.investing.com/news/company-news/john-deere-acquires-sentera-to-enhance-farm-tech-tools-93CH-4062084, https://ng.investing.com/news/company-news/john-deere-acquires-sentera-to-enhance-farm-tech-tools-93CH-1935578, https://agrigold.com/resources/agronomy-library/unleash-the-power-of-drones-sentera's-precision-agriculture-revolution, https://www.deere.com/en/news/all-news/john-deere-acquires-sentera/, https://sentera.com/agronomic-analytics/, https://senterasensors.com/resources/articles/fieldagent-mobile-stand-count/, https://www.prnewswire.com/news-releases/sentera-unveils-smartscript-weeds-formerly-aerial-weedscout-with-enhanced-features-for-2025-302352656.html, https://www.youtube.com/watch?v=s3zyyS8f_Yg, https://senterasensors.com/phx/, https://senterasensors.com/6x/, https://sentera.com/resources/news/new-ceo/, https://www.foodmanufacturing.com/consumer-trends/news/22941905/john-deere-acquires-drone-camera-maker-to-integrate-aerial-field-scouting, https://growjo.com/company/Sentera, https://www.realagriculture.com/2025/05/deere-elevates-aerial-field-scouting-with-sentera-technology/, https://www.farm-equipment.com/articles/24091-john-deere-acquires-sentera-to-integrate-aerial-field-scouting