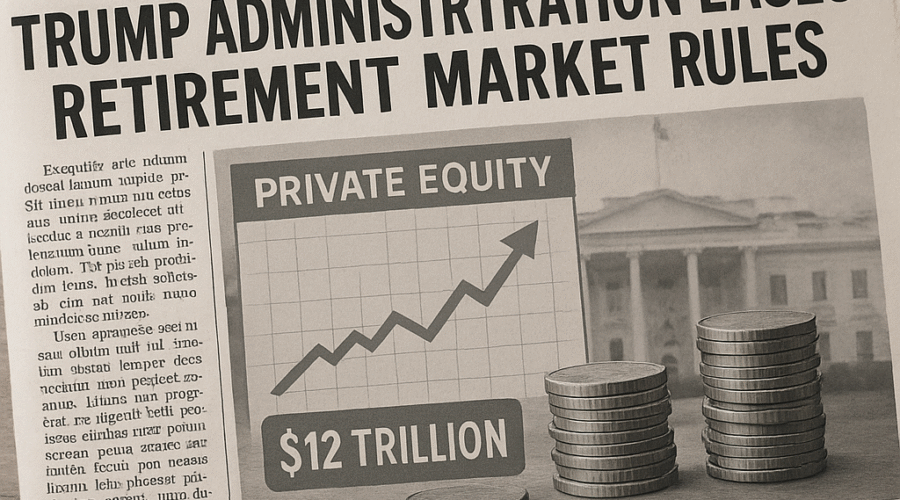

As the Trump administration prepares sweeping changes to retirement investment rules, Wall Street’s $8.7 trillion private equity industry stands poised to access America’s $12 trillion defined contribution market. This strategic pivot – enabled by key regulatory appointments and anticipated Department of Labor guidance – could fundamentally reshape retirement savings landscapes while sparking fierce debate over investor protections[1][2][21].

Regulatory Architecture: Rewriting the ERISA Playbook

The Aronowitz Nomination and EBSA’s New Direction

President Trump’s February 2025 nomination of Daniel Aronowitz to lead the Employee Benefits Security Administration (EBSA) signals a paradigm shift in retirement policy. Aronowitz, a vocal advocate for private equity in 401(k)s, recently argued in a Supreme Court amicus brief that excessive-fee lawsuits against plan sponsors create “absurd” fiduciary burdens[1][9]. His confirmation would likely accelerate efforts to:

• Raise legal thresholds for participant lawsuits over investment fees[1][34]

• Reinterpret ERISA’s prudence standards for alternative assets[4][16]

• Expand “qualified default investment alternative” (QDIA) definitions to include private market exposures[3][56]

Building on 2020 Precedents

The Trump administration’s June 2020 Information Letter – which first permitted private equity in target-date funds – created a regulatory beachhead now being expanded. While the Biden administration issued cautionary guidance in 2022, current DOL leadership appears ready to remove remaining barriers through:

• Revised fiduciary safe harbor provisions for plan sponsors[16][56]

• Streamlined valuation protocols for illiquid assets[7][31]

• Expanded “sophisticated investor” exemptions for large plans[6][20]

Market Implications: Reshaping Retirement Portfolios

Projected Private Equity Allocation in DC Plans

| Year | Avg. PE Allocation | Projected AUM |

|---|---|---|

| 2025 | 1.2% | $144 billion |

| 2030 | 4.7% | $564 billion |

| 2035 | 8.9% | $1.07 trillion |

Source: Analysis of DCIIA and P&I data[44][56]

The Liquidity Conundrum

While public pension funds average 12-15% private equity allocations, 401(k) plans face unique challenges. Most DC plans maintain <1% private market exposure due to daily valuation requirements and participant withdrawal needs[2][31]. New structured products from firms like Apollo and Blackstone aim to solve this through:

• Interval fund structures with quarterly redemptions[34][45]

• Secondary market partnerships for liquidity backstops[7][20]

• Blockchain-based tokenization of PE holdings[36][58]

Stakeholder Perspectives: Clashing Visions for Retirement Security

“You’re not a fiduciary if you don’t consider alts.”

– Charles Millard, former PBGC Director turned Blackstone advisor[45]

Industry Advocacy

Private equity leaders emphasize:

• Historical outperformance: 10.5% avg. PE returns vs 8.5% public equities (2000-2025)[6][20]

• Diversification benefits from non-correlated assets[5][51]

• Democratization of institutional-grade strategies[36][55]

Consumer Protection Concerns

Critics counter with:

• Fee compression: 2/20 PE fee structure vs 0.08% avg index fund expense[3][30]

• Valuation opacity: 90-day lag in PE NAV reporting vs real-time public pricing[7][31]

• Litigation risks: 127% increase in ERISA lawsuits since 2020[1][34]

Implementation Challenges: The Fiduciary Minefield

Plan Sponsor Dilemmas

Corporate fiduciaries face complex tradeoffs:

\( \text{Fiduciary Risk} = \frac{\text{Potential Returns} \times \text{Complexity}}{\text{Participant Financial Literacy}} \) [5][7]

Recent DOL audits show 68% of plans fail basic fee disclosure requirements, raising concerns about capacity to monitor PE investments[1][56].

The Education Gap

Surveys reveal:

• 73% of participants can’t define “carried interest”[30][50]

• 61% believe “private equity” refers to real estate investments[36][51]

• Only 12% understand the J-curve effect in PE returns[7][20]

Strategic Considerations for Institutional Investors

PE Due Diligence Framework for DC Plans

- ✅ Minimum 10-year track record

- ✅ SEC-registered interval fund structure

- ✅ Independent valuation committee

- ❌ Fund-of-funds with >1% layered fees

- ❌ Sector-specific funds without diversification

Source: Wagner Law Group ERISA Compliance Guidelines[16][59]

Emerging Best Practices

Forward-thinking plan sponsors are:

• Implementing tiered investment menus with PE opt-ins[31][45]

• Developing participant education VR simulations[36][51]

• Negotiating custom fee structures with PE managers[20][55]

Conclusion: Balancing Innovation and Prudence

As the Trump administration reshapes retirement regulations, institutional investors must navigate conflicting priorities between potential returns and fiduciary obligations. While private equity offers tantalizing alpha potential, successful implementation requires:

1. Robust participant education frameworks

2. Enhanced fee transparency protocols

3. Next-generation liquidity solutions

4. Continuous regulatory monitoring

The coming months will prove decisive as EBSA finalizes rules and the first wave of PE-enabled 401(k) products hits markets. For plan sponsors, the watchwords remain: prudence, transparency, and participant-centric design.

Sources

https://jacobin.com/2025/05/trump-aronowitzh-private-equity-retirement, https://pe-insights.com/private-equity-industry-to-lobby-trump-for-access-to-retirement-funds/, https://www.investopedia.com/private-equity-is-coming-for-your-401-k-8773283, https://www.dol.gov/sites/default/files/ebsa/about-ebsa/about-us/erisa-advisory-council/2011-hedge-funds-and-private-equity-investments.pdf, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3747684, https://pfaroe.moodysanalytics.com/allocation-strategies-for-public-pension-plans-traditional-vs-alternative-investments/, https://www.morningstar.com/content/cs-assets/v3/assets/blt9415ea4cc4157833/blt8ed10d703f5184c0/6578a24048987fa9e188d6d7/Morningstar_Does-Private-Equity-Enhance-Retirement-Investment-Outcomes.pdf, https://www.groom.com/wp-content/uploads/2022/11/Trump_Executive_Order_on_Retirement.pdf, https://jacobin.com/2025/05/trump-aronowitzh-private-equity-retirement, https://www.investopedia.com/private-equity-is-coming-for-your-401-k-8773283, https://www.investmentnews.com/retirement-planning/pe-industry-hopeful-about-401ks-in-second-trump-administration/258787, https://www.youtube.com/watch?v=Bageso_U_bA, https://www.politico.com/newsletters/morning-money/2025/02/18/why-this-carried-interest-fight-is-different-00204631, https://jacobin.com/2025/01/private-equity-biden-trump-retirement, https://www.cbsnews.com/news/trump-tax-taxes-carried-interest-loophole-hedge-funds/, https://www.wagnerlawgroup.com/blog/2022/02/dol-clarifies-guidance-on-private-equity-investments-in-defined-contribution-plans/, https://www.politico.com/newsletters/morning-money/2025/02/18/why-this-carried-interest-fight-is-different-00204631, https://www.politico.com/newsletters/morning-money/2024/10/23/wall-street-makes-its-trump-bet-00185001, https://www.politico.com/story/2017/02/donald-trump-union-strike-234709, https://eqtgroup.com/thinq/Education/pension-funds-and-private-equity-how-they-work-together, https://jacobin.com/2025/05/trump-aronowitzh-private-equity-retirement, https://www.businessinsider.com/trump-401k-fees-lawsuits-private-equity-apollo-kkr-2025-2, https://www.politico.com/newsletters/morning-money/2024/06/06/a-public-demise-for-the-secs-private-fund-rules-00161939, https://www.empower.com/press-center/empower-offer-private-markets-investments-retirement-plans, https://www.thecipherbrief.com/report/open-source-report-for-tuesday-may-20-2025, https://www.businesstimes.com.sg/companies-markets/transport-logistics/boeing-marks-comeback-crisis-record-qatar-airways-deal, https://www.gibsondunn.com/dei-task-force-update-may-16-2025/, https://newrepublic.com/post/195324/trump-administration-crimes-jail-time, https://www.planadviser.com/trump-issues-executive-order-create-sovereign-wealth-fund/, https://www.investopedia.com/private-equity-is-coming-for-your-401-k-8773283, https://www.investmentnews.com/retirement-planning/pe-industry-hopeful-about-401ks-in-second-trump-administration/258787, https://www.groom.com/resources/two-new-executive-orders-promise-to-impact-retirement-and-health-plan-guidance/, https://www.youtube.com/watch?v=Bageso_U_bA, https://www.businessinsider.com/trump-401k-fees-lawsuits-private-equity-apollo-kkr-2025-2, https://www.employeefiduciary.com/blog/trump-executive-order-on-retirement-plans-falls-short, https://economictimes.com/news/international/us/12-trillion-temptation-private-equitys-push-into-retirement-plans-sparks-warnings-from-top-johns-hopkins-researchers-heres-how-americans-should-track-their-hard-earned-money/articleshow/119982916.cms, https://www.planadviser.com/trump-issues-executive-order-create-sovereign-wealth-fund/, https://www.ebglaw.com/insights/publications/executive-order-14173-how-public-companies-dei-initiatives-may-be-targeted-and-key-actions-to-take-now, https://www.ai-cio.com/news/trump-signs-executive-order-to-establish-us-sovereign-wealth-fund/, https://www.youtube.com/watch?v=VQx5DcBC_DE, https://about.bgov.com/solutions/from-oath-to-action/trumps-2025-executive-actions/, https://www.epi.org/policywatch/, https://www.investmentnews.com/retirement-planning/pe-industry-hopeful-about-401ks-in-second-trump-administration/258787, https://www.plansponsor.com/practical-implications-dols-latest-private-equity-statement/, https://www.youtube.com/watch?v=Bageso_U_bA, https://www.youtube.com/watch?v=lEVdOtM0tBA, https://www.wsws.org/en/articles/2020/07/04/401k-j04.html, https://www.investmentnews.com/retirement-planning/pe-industry-hopeful-about-401ks-in-second-trump-administration/258787, https://www.businessinsider.com/trump-401k-fees-lawsuits-private-equity-apollo-kkr-2025-2, https://www.investopedia.com/private-equity-is-coming-for-your-401-k-8773283, https://www.kiplinger.com/retirement/ways-trump-could-change-your-retirement, https://jacobin.com/2025/01/private-equity-biden-trump-retirement, https://safemoney.com/blog/trumps-election-impact-on-retirement-accounts/, https://www.investmentnews.com/retirement-planning/dol-tones-down-trump-era-statements-on-pe-in-401ks/215432, https://pe-insights.com/private-equity-industry-to-lobby-trump-for-access-to-retirement-funds/, https://www.plansponsor.com/practical-implications-dols-latest-private-equity-statement/, https://www.psca.org/news/psca-news/2025/2/trump-orders-erisa-guidance-for-america-first-investment-policy/, https://www.planadviser.com/trump-issues-executive-order-create-sovereign-wealth-fund/, https://www.asppa-net.org/news/2021/12/dol-clarifies-guidance-private-equity-401k-plans/, https://www.dechert.com/knowledge/onpoint/2021/12/the-pendulum-swings---department-of-labor-changes-its-tone-for-p.html