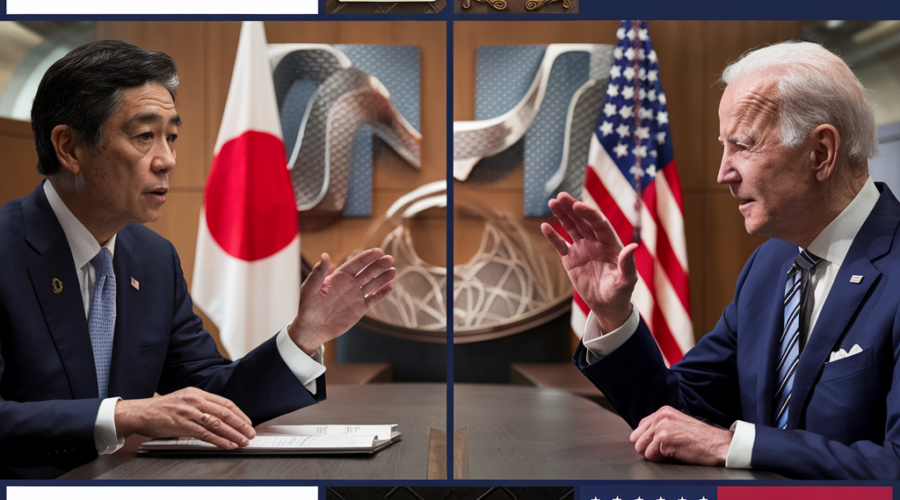

- Geopolitical Implications: The Nippon Steel-U.S. Steel merger aligns with the Quad alliance’s economic security agenda, enhancing regional supply chain resilience.

- National Security Concerns: President Biden blocked the $15 billion deal citing national security risks, sparking backlash from Japan and the business community.

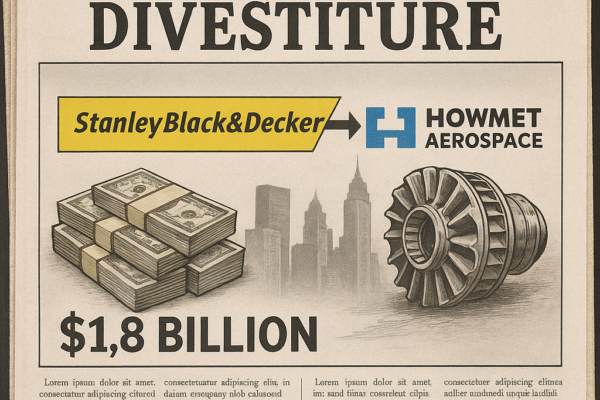

- Economic Impact: The merger aimed to revitalize aging U.S. Steel facilities through $2.7 billion in investments, boosting competitiveness against China.

- Industry Consolidation: Consolidation in the global steel markets could drive innovation, pricing dynamics, and supply chain efficiencies.

- Job Security Debate: While Nippon Steel committed to retaining U.S. leadership, opponents raised concerns over potential job losses.

- Historical Context: Past steel mergers like ArcelorMittal’s acquisitions faced intense regulatory scrutiny, reflecting geopolitical complexities.

- Stakeholder Perspectives: Analysts debate the merger’s impact on national security, job security, and market competition.

- Legal Challenges: Nippon Steel and U.S. Steel are expected to pursue legal action challenging Biden’s order, prolonging the dispute.

- Future Outlook: The deal’s outcome will set a precedent for foreign investments in the U.S., shaping the Indo-Pacific trade landscape.

- Call to Action: CEOs and industry leaders should closely monitor developments, as the implications for global steel markets are significant.

References

- Nippon Steel Corporation and U.S. Steel Condemn U.S. Government’s Unlawful Decision

- Japan PM tells Biden ‘strong’ concerns over steel deal

- Japan PM urges Biden to address concerns over U.S. Steel deal

- Biden Blocks the Proposed Sale of U.S. Steel to Nippon Steel